Crypto Outlook and Watchlist for the Week: Rally or Further Sink in Deep Bearish Territory?

Update: 04 Jan 2021 - Added charts after holidays. With Fed rate hikes for 2022 already priced in by now after Jerome Powell's announcement last time, signaling the beginning of yet another bear cycle in cryptocurrencies (reminiscent of 2018) as well as tech stocks' continuous slide yesterday, is there momentary hope for a short-term rally this week or are we gonna sink deep down in bearish territory?

|

| No one can't blame Elon Musk himself for selling TSLA shares yesterday (click to see bigger version). |

Given this DXY outlook of going ranging near 96 (0 fibonacci) by the remaining days of the year, before potentially climbing further up to 99-100 by the end of December or some time in Q1 next year, Bitcoin might rally a bit to 49-50k next week, before continue sliding down somewhere around 38-40k (latest 61.8 fib):

I really don't think Bitcoin will climb to 100k by end of this month given how BTCUSD moved back in 2017-2018 and even 2013-2014, as well as the fact that the Fed is raising rates by next year to curb inflation. IMHO, it's just old money whales' attempt to lure the public and dum dum money on media because most likely they bought at 60k lol.

But then again who knows? The situation now compared back then is way different. Other than the pandemic, there are countries now adopting Bitcoin and other crypto as their currency because their own currency is devalued by hyperinflation.

Only time can tell -- at least we'll see by December 31.

In the long-run, I believe BTCUSD will reach 200k after the next 2024 halving:

But for now, if someone's gonna ask me, Bitcoin will start moving sideways at $38k-40k, by end of this year up to early Q1 next year, again around the 61.8 fib level above, which I'm glad coincides with what Cryptoface is trying to predict in his latest stream (as of this post).

|

| Source: Cryptoface |

Speculative assets with high future valuations like tech stocks and crypto are appealing to investors when interest rates are low, but if not, the market becomes risk-off and more likely, we're gonna see further recovery of bonds soon.

|

| Source: Bloomberg and FT.com |

With that said, since I tend to day trade (sometimes scalp lol) in crypto unlike with stocks which I position trade, and FX which I swing trade (except for GBPUSD and sometimes oil and metals), I'm waiting for a good opportunity to buy a short rally -- a bounce back-- in the following coins in the next few days or so (unless again, Bitcoin decides to quickly slide straight down to my 61.8 target at 39k instead of rallying a bit to 50k).

Disclaimer: This is my own analysis and guide for the week for my own trades, and shouldn't be treated as financial advice. Do your own due diligence and see our Disclaimer policy here. Trade at your own risk.

Crypto Watchlist for the Week (or at least in the next few days)

I'm not gonna be trading BTCUSD again this week unless it reaches my target 50k first -- and then see another bearish momentum. However, the coins below are the ones I'm eyeing for especially if BTCUSD will indeed rally in the short run because they have better technicals for me.

BTCUSDT

If BTCUSD rallies to 50k, I'll be a degen and put high leverage on some of these coins below lol! If not and Bitcoin continues to slide down, I'll stick to FX and checking out DeFi Kingdoms (or I might actually have the courage to short BTC like last month up to 40k, if not 39k).

SHIBUSDT

Waiting for that boost again in this meme coin to 0.000050 at least (0 fib level). But must be VERY weary of bull trap between 0.000025-0.000031. Risky coin, but coins like this tend to just randomly shoot up, depending on Elon's tweets like DOGE.

Aftermath:

SANDUSDT

Best to enter long somewhere between 3.60 - 4.00 (new 61.8 fib). But if technicals and candles support reversal -- which is most likely, given the bullish money flow (unlike BTC & SHIB above), will enter at 4.72-4.75.

Aftermath:

LRCUSDT

Waiting for LRCUSDT to show bullish confirmations on lower timeframes at around 2.00 (preferably lower at 1.83 -- prior period's 100 fib level) before going long.

Aftermath:

DOTUSDT

I never really trade this coin (I already regret doing so with ADA before -- which in my opinion, is as stressful as trading ALICE). Just adding it here because it has interesting price levels and fundamentals (scalable and runs in "parachains", part of top 20 in market capitalization, also founder is previous Chief Tech Officer of Ethereum Foundation). Maybe somebody somewhere out there has a knack in trading (or investing in) this. I might buy this but only if I get enough bullish confirmation.

Aftermath:

The following are some other coins on my radar which I find too risky to buy (for now), but nice to look at:

XRPUSDT

Quite risky to enter now unless settlement is over especially if bitcoin also continues its bearish trend, ripple can slide down to 0.56 (both weekly and daily 61.8 fib). Else, if that current trend holds, might ride it up to near 1.00.

Aftermath:

XMRUSDT

Given the strong bearish money flow, most likely this XMRUSDT will drop to 150 before rallying up to 185-200 (61.8 fib), if not 243-245.

Aftermath:

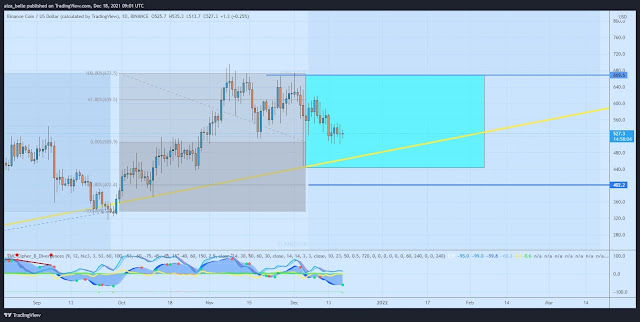

BNBUSDT

Waiting for BNB to reach 500 or lower (near its trendline), aside from other bullish signals before going long.

Aftermath:

ADAUSDT

Based on price action and divergence shown below, ADA seems to be a good buy at 1.25 (previous period's 61.8 fib). But with that bearish money flow, it's highly likely for it to drop below 1.0 first (bull trap) before recovering.

Aftermath:

HOTUSDT

Another coin which I've never traded before (and I don't know if I ever will lol). It got on my radar because it was bleeding a lot lately and now I'm seeing very interesting divergence. The weekly 61.8 fib level at 0.006 seems to be a good entry if divergence continues, and bullish candles and money flow begin to show. Else, the daily 61.8 fib level at 0.003 is the next potential entry. Kinda weary of this now unless they officially replace HOT with HoloFuel.

Aftermath:

Featured image by Alexas of Pixabay.

0 comments:

Post a Comment