FX Outlook for the 2nd half of October 2020

Market remains on a cautious conservative wait mode. Updated on 11/11/2020: Added charts after elections week and some brief commentary.

Disclaimer: Everything that's written here are mainly the author's opinion subject to current situation and assumptions (ceteris paribus) and doesn't account for any future changes in them (especially unexpected ones). Do your own research and don't take this as financial advice.

DXY

📌 Initially consolidate near 92.5 first before either recovering up to 95 or go sideways by November

Non-manufacturing PMI figure last week was slightly higher (57.8) than expected (56.3), while both adjusted unemployment claims for October 1st and last week's figure were both significantly higher than anticipated (849k vs 837k, and 840k vs 820k, respectively), which inhibits USD recovery and increasing the possibility of DXY to drop down to at least 92.5 first for the remaining half of October before recovering by either end of October or early November.

But if another round of US stimulus package is approved, expecting DXY to go down and breakout its current 92 low (and 0 fibonacci level), while gold shoots up higher.

DXY by October 31:

EURUSD

📌 Potential spike up and stop hunt at 1.20 before dropping to 1.155

Industrial production figures in Euro area -- particularly Italy and France showed greater numbers than expected.

However, potential for ECB to make a move soon after worries about rising inflation because of Euro appreciation (along with bearish USD in the short-term), might cause a reversal in EURUSD soon-- forming a bearish W in its weekly chart:

EURUSD after US elections in November 2020:

The spike and stophunt near 1.20 didn't happen and EURUSD decided to drop right away instead up to 1.16. However during election week, it climbed towards 1.19.

GBPUSD

📌 Either remain range-bound between 1.28-1.305 or sudden drop towards 1.265 by next month

Though there's a possibility that GPBUSD will remain range-bound for the latter half of October, general market sentiment regarding the effectiveness of BCG vaccine against the spread of virus in UK, and its new three-tier lockdown efforts will remain at play.

GBPUSD by October 31:

GBPUSD after US elections in November 2020:

It only dropped within the range (1.285) before climbing its way indeed to 1.35 starting election week up to now instead of dropping to 1.265 -- whether that's still bound to happen after the expected spike (sometime by end of this month) or not, remains to be seen.

AUDUSD

📌 Range-bound between 0.705 - 0.74

Despite a potential USD weakness and bullish bias on gold, I think recovery will only up to 0.74 at most for this month especially with RBA's recent dovish tone. Whether it does move up to 0.74 or drop to 0.705 right away instead depends on the actual unemployment rate and employment change to be released this week, as well as CPI and RBA statement in the following weeks.

AUDUSD after US elections in November 2020:

Continued dropping up to 0.699 before seemingly climbing its way now to 0.74.

USDJPY

📌 Either might get volatile towards 107 (0 fibonacci level) or inch its way down to 104 (and eventually 100).

Unless something happens that will cause a surge on USD value and show a bullish engulfing candle in the weekly chart (and consistent upward trend in lower timeframes), USDJPY will continue to drop down to 104 (-38.2 fibonacci level) before possibly creating a spike to its 2016 low (-61.8 fibonacci level) especially as the yen is most likely to continue appreciating along with gold as uncertainties regarding the pandemic continues

It continued dropping further even way past 104, reached 103 during elections week but started rebounded the week after.

USDCHF

📌 Possible recovery to 0.92 this month (2018 low) before dropping down to 0.88

Similar to USDJPY (with CHF also being treated as safe haven asset), expecting this pair to recover in the short-term before dropping down to 0.88 (-61.8 fibonacci level) especially with stronger Swiss economy as indicated in its considerably better than expected KOF Economic Barometer figure (113.8 vs 106.1)

USDCHF after US elections in November 2020:

It did recover up to 0.92 before dropping to 0.897 only during elections week and then rebounded the week after.

USDCAD

📌 Rally towards 1.33 before dropping down to 1.30

Despite Canada's lower than expected trade balance figure last week (-2.4B vs -2.1B), CAD remained stronger against USD with better than expected Employment Change and Unemployment Rate figures (378.2k vs 150k, and 9% vs 9.8%, respectively).

Recovered up to 1.339 and dropped at 1.297.

USDMXN

📌 Slide down to 20 but possible recovery near 21.5 first

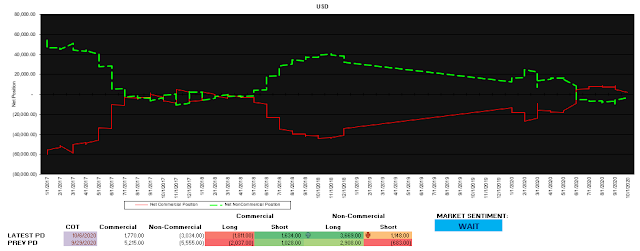

Despite the weekly chart showing a possible bullish triangle breakout for USDMXN, the bullish trend of MXN on COT among non-commercial traders suggest otherwise -- which is also aligned with uncertainty regarding the next US stimulus package.

USDMXN by October 31:

USDZAR

📌 Rally to 17

Unlike USDMXN, USDZAR is most likely to rally soon towards at least 17 especially it has now reached its support at 16.2 (0 fibonacci level) -- at least from a technical standpoint, especially current sentiment among non-commercial traders now for ZAR is mixed.

USDZAR by October 31:

USDZAR after US elections in November 2020:

Didn't expect ZAR to be THAT strong indeed against USD, USDZAR dropped further down to 15.56 during elections week -- whether it will continue to drop towards its 2019 high and prior year 61.8 fibonacci level at 15.275 remains to be seen.

Featured image by Kai P. of Unsplash.

0 comments:

Post a Comment