Is FX Seasonality Strategy Still Relevant Nowadays? (and Trading Blog Update)

The short and obvious answer is "No", but with an exception.

Feels great to finally get back to blogging about my trading journey!

Back in summer, I decided to have a blog hiatus (but not a trading hiatus!) after realizing that the virus had been mostly downplayed (and politicized), and given the current unusual circumstances, I didn't think the usual methods I use in analyzing and forecasting trades would work -- particularly the FX seasonality -- and I needed some time to make some changes.

TABLE OF CONTENTSI. Update About Monthly Forecast in FX CurrenciesII. FX Major Currency Pairs III. Other Currency Pairs IV. Conclusion |

I. Update About Monthly Forecast in FX Currencies

Although I use other tools and strategies together with FX seasonality, ever since I started incorporating it in my analyses back in late 2018, I've relied on it in determining the possible overall direction of the prices every month, even more than market sentiment, weekly economic events and numbers, and things portrayed in the news.

Since we never had this similar situation for the past 10 years, and the focus of the government and businesses from different countries have shifted, I've stopped using FX seasonality and switched back to my previous method in analyzing trades -- with less exposure to the news and fundamentals this time, and more reliance on price action and technicals instead since it's harder to determine long-term trends given the current uncertainties not only about the virus itself and when it will last, but also about how different countries handle the pandemic.

II. FX Major Currency Pairs

I'll be giving some hint on the methods I use in my trades nowadays, plus some opinions (or general forecast) regarding currency pairs for October in the succeeding posts. But to remind myself to be quick enough to make changes when things start making less sense, I just made some brief observations and notes below regarding the impact of the virus on FX currencies, particularly how it made them deviate from their major trend, aka seasonality.

DXY

DXY had been a hit or miss ever since when it comes to its seasonality -- except for major trends such as the general bearishness around August, and bullishness around end of the year. However, for 2020, it started dropping earlier and remained flat by August instead.

There had been some recovery by September, however in my opinion, DXY is most likely to drop back to 92 (0 monthly fibonacci level), and even go ranging there especially the more we get closer to the US elections, before going on one direction or the other -- it could go up if stocks go down, or even vice versa, either by end of 2020 or early next year (we'll see).

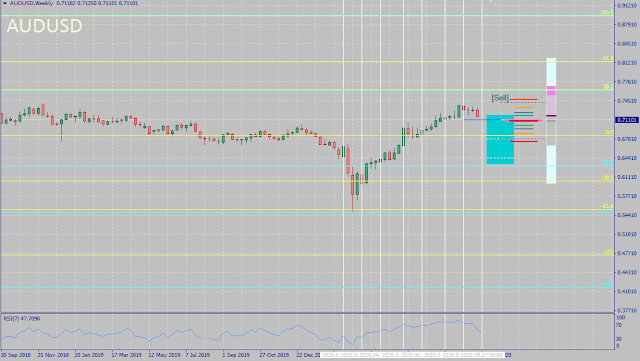

AUDUSD

|

| AUDUSD FX Seasonality 10-yr win-rate: 63% |

By September, AUDUSD seems to finally start aligning again with its seasonality, which might continue until at least before the next US elections.

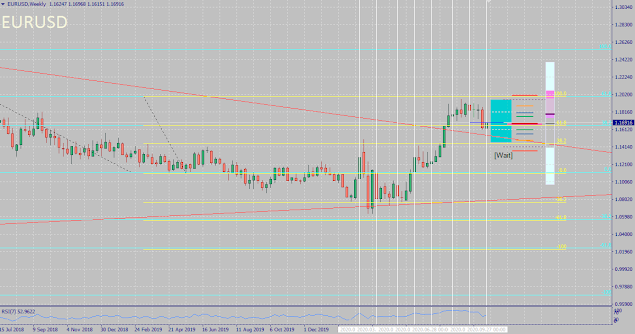

EURUSD

|

| EURUSD FX Seasonality 10-yr win-rate: 73% |

Unlike the Aussie, the Fiber had been less bearish back in March but still got more volatile than prior months. It did start recovering by May though despite the usual bearish seasonality of that month, and continued going bullish in July before plateauing around August to September (months that were predicted to be seasonally bullish for EURUSD) after going past its monthly trend line and the 38.2 fibonacci level.

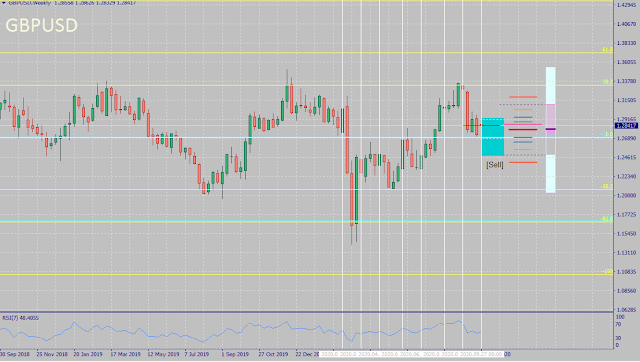

GBPUSD

|

| GBPUSD FX Seasonality 10-yr win-rate: 67% |

GBPUSD didn't drastically drop by June though despite its bearish seasonality for that month (usually it's around June when the UK parliamentary does something that affects the pound and depreciates it. But this time, everyone's busy dealing with the pandemic).

By July to August, GBPUSD started recovering up until near its current 61.8 monthly fibonacci level, before starting to reverse again by September.

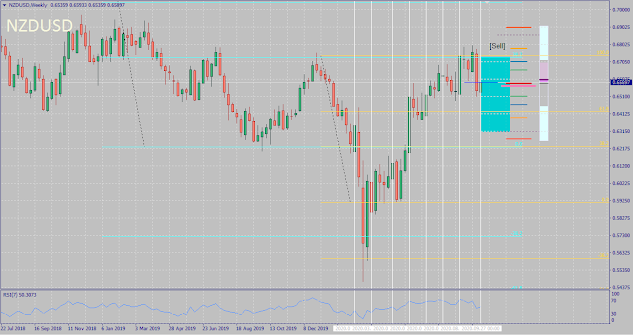

NZDUSD

|

| NZDUSD FX Seasonality 10-yr win-rate: 63% |

The Kiwi moved almost similar to the Aussie-- high volatility around March and recovery by May despite the bearish bias in its seasonality for both currency pairs around that period. However unlike the Aussie, Kiwi just recovered slightly by July to August and remained under that 38.2 monthly fibonacci (100 weekly fibonacci) level instead of breaking past it.

By September, NZDUSD continued ranging as if trying to break out its current 0.68 high but sellers exerted more downward momentum by 3rd week of September.

USDCAD

The reverse is the case for the remaining FX majors such as the Loonie. It experienced high volatility as well during March when the worldwide lockdown began. But instead of recovering last May like the other majors, the loonie continued its reversal due to weaker USD and higher cases and death rates in the US.

Despite the relatively flat seasonality for July to August, USDCAD continued going down until it reached near 1.30 at 38.5 monthly fibonacci level (100 weekly fibonacci level), and started recovering by September.

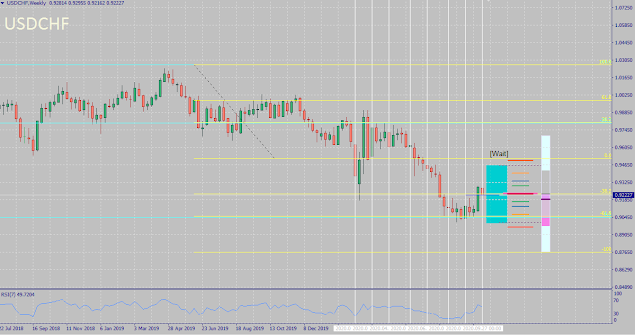

USDCHF

|

| USDCAD FX Seasonality 10-yr win-rate: 69% |

Like the Loonie, the Swissy also became highly volatile in March. However, it didn't plunge down by May but remained flat instead, before falling by June to July. It remained flat in August and didn't break past that 0 monthly fibonacci level (61.8 weekly fibonacci level) near the 0.90 psychological level.

USDJPY

|

| USDJPY FX Seasonality 10-yr win-rate: 82% |

Unlike the major FX pairs discussed above, USDJPY is the only one that remained consistent in its seasonality despite the unusual circumstances we're in since March.

I can't really pinpoint yet why. I initially thought maybe JPY pairs are generally like that, but it's not actually the case when it comes to other JPY pairs.

I have a suspicion that it's USD itself going opposite its seasonality overall -- either as an effect of USD depreciating further the more it's used in stimulus packages, or as a way to reduce the FX effect of foreign debt (or both).

Pairing a stronger JPY with Japan having an export-reliant economy and negative interest rates, in which the latter never really helped boost its economy (unlike say, Switzerland and its CHF), acts as a "magnifier" to a weak USD, and making the effects of this pair's seasonality more pronounced and consistent that no virus or pandemic can budge it.

But that's just my own theory, and maybe there are other factors at play.

III. Other Currency Pairs

The same inconsistency in FX seasonality can be said when it comes to minor and exotic FX pairs -- even in pairs that have 70% and up 10-yr win-rate such as the following:

EURCHF

|

| EURCHF FX Seasonality 10-yr win-rate: 70% |

Like the Fiber, EURCHF had a major recovery bounce by May, and not a drastic drop by June as shown in its seasonality. It struggled to climb by July near 1.09, and by August to September, continued to test that current high.

USDMXN

|

| EURCHF FX Seasonality 10-yr win-rate: 71% |

For this favorite exotic pair, price generally consistently moved opposite from its seasonality despite the high win-rate (unlike USDJPY), except for mid September when it started going bullish again like its seasonality.

Will USDMXN mirror its seasonality still in the remaining quarter this year?

We'll see.

IV. Conclusion

Although if we look at the bigger time frame, the patterns in FX seasonality may probably still apply for the most part, there are dangers in using hasty generalizations similar to the "safe" belief that the stock market continue going up and being oblivious to sudden hiccups and uncertainties about the timing of recovery.Oftentimes when something had been working well for quite some time, it's easy to be too reliant on it, and using it like a crutch, especially after being more suspicious of the news and media overall.

The market doesn't always "make sense" regardless of the depth of analysis, or how complex or simple the tools and methodologies we use.

If there's one thing that this virus teaches everyone (aside from the obvious cliche of never putting all eggs in one basket especially a lot of people lost their jobs during this time), it's enhancing ones agility and adaptability especially during uncertain times.

0 comments:

Post a Comment