S&P 500 and Global Recession: Best Recession-Proof Stocks and Other Assets

Is S&P 500 gonna slide further down to 2500 or suddenly shoot up to 4k? Who knows. Is it similar to the dot-com era? Not really. But here's how to recession-proof if ever the inevitable happens.

I was actually planning to post this last week, but decided against doing so and simply wait for market confirmation first so I won't get accused of fear-mongering.

Anyway, I've been listening to long-time elliott wave traders in S&P 500 and initially patterned my fibonacci based on their count.

However, I'm not very comfortable with how often we need to readjust the latest wave-- some believed wave 5 is gonna end around 2018 and adjusted it with the current price levels now. Others believed wave 5 should have ended way back in 2013 (this is probably the correct one -- I'll explain in a bit).

Regardless of how arbitrary elliott wave seems, I'm actually a huge believer that repeating patterns or fractals -- the core basis of elliott wave -- exist in nature. That includes human nature or psychology if we look at it on a mass scale, as illustrated well by this, aside from the current movement in the markets.

Since nature has a set of rules, I strongly believe that living things have patterns and can also be "measured".

|

| by G.C. Peters of Unsplash |

Though there's no way to know whether a crop will grow or rot, the same way we can't exactly determine if new markets will thrive or crash, we can still closely estimate how far a crop will grow (if it survives to its fullest) and when we should harvest (and plant new ones).

I. Good Old Fibonacci

So I now ignored elliott wave for the meantime, and finally did my own fibonacci count based on what a long-time trader grandpa taught us and how I use fibonacci in FX trading too.I started my count as far back as I can go, and came up with the following guidelines (meaning, it can be broken and not strictly followed depending on the situation):

SELL

- divergence in RSI and chart on -61.8 fib or higher (-61.8 becomes new 0 fib) and RSI above 70 for sell

- sell up to around 0 fib of prior period and RSI below 30 (then soft buy-soft sell) OR

- sell up to near -61.8 of current period (if there is prior bearish period & fib) or -100 of current period (if bearish reversal)

SOFT BUY

- RSI below 30

- price below -38.2 fib of prior period

- buy up to near -61.8 of current period

SOFT SELL

- 2nd RSI above 70

- price above -38.2 fib of current period (if prior fib is also bullish) or near -100 fib

- sell up to near 0 fib of current period

BUY

- divergence in RSI and chart on 0 (-61.8 fib or higher of prior bullish period) and RSI below 30 for buy

- buy up to around -100 fib of prior period and RSI above 70 (then soft sell-soft buyl) OR

- buy up to near -61.8 of current period (if there is prior bullish period & fib) or -100 of current period (if bullish reversal)

SOFT SELL

- RSI above 70

- price below -38.2 fib of current period

- sell up to near -61.8 of prior period

SOFT BUY

- 2nd RSI below 30

- price at 0 fib of current period

- sell above -38.2 fib of current period

These are the rules:

- For reversals, plot fibonacci either from prior period -100 or -61.8 fib level (depending on where price is nearest) down to prior period 0 fibonacci level

- If price continues to trend up or down, way past the -100 fibonacci level, plot that as new 0 fibonacci level and add a hype icon (champagne glass or caution)

- RSI is set at 10-70-30 on the weekly chart only

You can see them in action here (go as far as you want and scroll from right to left - click fullscreen mode):

I like setting rules and guidelines because now we have something consistent, measurable, and not seemingly arbitrary (if it's an indicator, it's called no repainting).

Back to Top

II. Interesting Events Coinciding Market Downturns

After plotting fibonacci levels and noting down the years when we should ideally buy and sell, Googling a bit of market history, and cross-checked some of the years in history, here are some interesting observations.These stock market downturns (marked with purple arrow) are part of the normal ebb-and-flow in the market:

1881 - Year before the 1982-1985 Price Depression (after the Panic of 1873, boom in railroad construction and Great Railroad Strike)

1968 - Year before the 1969-1970 mild recession when Fed raised interest rates to address budget deficits coming from Vietnam War

2007 - Year (or rather months) before the Dec 2007 - June 2009 global recession caused by the subprime mortgage crisis

The years when a downturn "should have happened" (marked by champagne glass icon symbolizing unrelenting optimism in the markets), but something saved the markets and continued lifting stocks up:

1899, 1905, 1925, 1927, 1928, 1954, 1958, 1964, 1972, 1980, 1983, 1989, 1994, 1997, 2013, 2017

These are the years when the inevitable downturn or crash (that should have happened in the years above) finally happened:

1902 - a year after President McKinley got assassinated, severe drought occurred and also the 1901 stock crash

1906 - a year before the Panic of 1907, and because of that panic, the Federal Reserve System was born

1929 - Wall Street Crash of 1929 and beginning of the 1929-1933 Great Depression

1956 - Red Scare era and Suez Canal crisis, also a year before the Eisenhower Recession

1962 - Kennedy Slide of 1962 with his antibusiness sentiment against US Steel

1966 - Credit Crunch of 1966 and escalation of Vietnam War

1973 - Oil Crisis and stagflation recession

1987 - Black Monday stock market crash

2000 - a year before the speculative dot-com bubble and 9/11 attack

And here are the number of years in between the ideal year to buy to (unrelenting optimism point to) ideal year to sell (which corresponds to market downturn/crash):

1877 - 1881 4 yrs | 4 yrs

1884 - (1899) - 1902 (15 yrs) - 3 yrs | 18 yrs

1903 - (1905) - 1906 (2 yrs) - 1 yr | 3 yrs

1907 - (1925) - (1927) - (1928) - 1929 (18 yrs) - 2 yrs 1 yr - 1 yr | 22 yrs

1932 - (1954) - 1956 (22 yrs) - 2 yrs | 24 yrs

1957 - (1958) - 1962 (1 yr) - 4 yrs | 5 yrs

1962 - (1964) - 1966 (2 yrs) - 2 yrs | 4 yrs

1966 - 1968 2 yrs | 2yrs

1970 - (1972) - 1973 (2 yrs) - 1 yrs | 3 yrs

1974 - (1980) - (1983) - 1987 (6yrs) - (3 yrs) - 4 yrs | 13 yrs

1987 - (1989) - (1994) - (1997) - 2000 (2 yrs) - (5 yrs) - (3 yrs) - 3 yrs | 13 yrs

2002 - 2007 5 yrs | 5 yrs

2009 - (2013) - (2017) - (4 yrs) - (4 yrs) - ? yrs | ? yrs

At first I got excited because majority of the number of years are fibonacci numbers (or close!). Probably there's a pattern or formula here somewhere, especially if grouped together based on similar major events.

If there are any mensa people or math geniuses out there that figure something out (and my too normie brain missed), up to you to share it (or not). But I wish you the best of luck in your trades.😄

The main thing I learned here so far is recession happens a year after a market euphoria that doesn't have solid and strong fundamentals to back things up.

Does that look like what's happening now?

YES.

Back to Top

III. What's the Current Market's Weakness(es)?

So far the weakness I'm seeing (aside from the obvious slowdown and fears triggered by the corona virus), is central banks not having enough ammo with their very low to negative interest rates.In some economies, like in Japan and Europe, no matter how low they set rates, which not only provides incentive for commercial banks to lend out more cash to businesses since they can borrow from the central banks at lower rates, it also depreciates their currencies and makes their exports more competitive.

|

| Me just chillin' & making memes while waiting for things to unfold in the markets and for my trades to actually hit their targets 😎 |

Despite that, plus other stimulus like quantitative easing and tax cuts, GDP remains low, with increasing trade deficits (except for Germany), and higher debt-to-GDP ratio despite having a stagnant economy.

Almost the same thing is happening in the US and China-- except that consumer spending is also high in them, which is good, and somehow money printed by central bank goes back to the government through consumption taxes and help payoff the minimum required in debt to avoid defaulting.

Going back to low interest rates, aside from depreciating currencies which increases debt through foreign currency translation, low rates discourages investors from investing in government bonds and choose to put money somewhere else: prime example is stocks, that's why bonds and equity yields began decoupling in the last few years.

But the rising anti-establishment populism, increased tariffs and "de-globalization" sentiment aren't giving companies a favor, and if these circumstances discourage people (or rather, the whales) from buying their stocks, then...

There's also other assets vying for the whales' funds like cryptocurrencies, space investments, art and good old gold which are also a good hedge against recession.

Back to Top

IV. When is Recession Most Likely to Happen?

Imho, it already started right when the equity and bond yields inversion happened and it's just been brushed off because it hasn't trickled down the masses yet.Assuming a recession is the more realistic scenario considering the things mentioned earlier, and the similarity of the trend now to pre-dot com bubble era, I compared the following charts:

How these 2 charts look, plus the elliott wave traders confirming we're in the 5th wave now, a crash is bound to happen anytime soon (edit: it already started last week lol!). I just can't tell whether someone or something's gonna prop prices up to 4500 -- like $TSLA and $SPCE for instance, and possible a better Phase 2 US-China trade deal?

Or if it's gonna dilly-dally sideways a bit until US elections, before sliding down to 2500 (or lower) around end of this year.

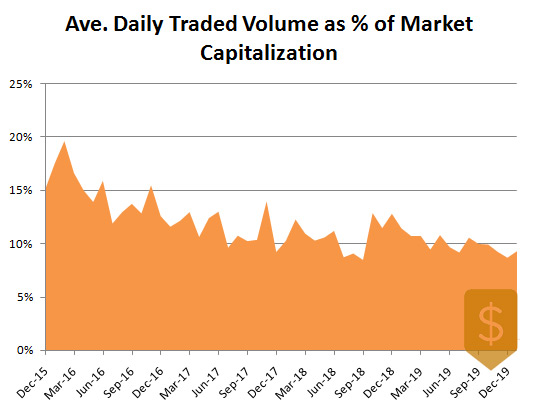

Although total traded volume remains steady, the average daily movement as a percentage of market capitalization seems to be decreasing over time and not very encouraging to buy more stocks in general until a "bottom" is confirmed (the trickiest for me to do even with the fibonacci thing I did above-- I can spot the euphoria but not market's willingness to try and buy again...).

|

| Source: Yahoo Finance |

|

| Source: Yahoo Finance, ShutUpandTrade |

V. Recession-Proof Stocks and Other Assets

Despite this post being mainly focused on the S&P 500, given the current factors mentioned earlier and dynamics in global economy, it's probable that if ever a recession occurs, it's not gonna be limited to the U.S. only but will spread globally-- or it might even actually start somewhere else like China (where the coronavirus started recently), or somewhere totally unexpected (if something like the european sovereign debt crisis pop its head again).

So here are some most likely recession proof-stocks (Disclaimer: these don't necessarily protect you from loss, but they will at least either minimize it or will only experience minimal drop themselves. This doesn't serve as a recommendation though and it's best to do your own diligence):

Cheap basic consumer goods stocks

Regardless of what's gonna happen in the market, people will always have to attend to their most basic needs.- Dollar Tree (NASDAQ: DLTR)

- Walmart (NYSE: WMT)

- Kroger (NYSE: KR)

Cheap food & spices

And people will also need to eat.

- Hormel Foods (NYSE: HRL)

- McDonald's (NYSE: MCD)

- McCormick (NYSE: MKC)

Simple entertainment

People will seek out an escape to the sad reality through simple pleasures and entertainment.- Hasbro (NASDAQ: HAS)

- Budweiser (NYSE: BUD)

- Philip Morris (NYSE: PM)

- Google (because of the shift to Youtube) (NASDAQ: GOOGL)

- Netflix (NASDAQ: NFLX)

Pharmaceuticals

With coronavirus floating around, pharma companies are more in-demand than ever.- Novartis (SWX: NOVN)

- Abott Laboratories (NYSE: ABT)

- Bristol-Myers Squibb (NYSE: BMY)

Very mundane (and boring) utilities and services stocks

- H&R Block (NYSE: HRB)

- Church & Dwight (NYSE: CHD)

- Pulte Group (NYSE: PHM)

Other Recession-Proof Assets to Consider:

- gold (classic one)

- art works from renowned artists and young emerging artists (their value never goes down regardless of what's happening in the markets)

- cryptocurrencies (now is the time to hodl especially with bitcoin halving happening soon-- and "interesting" malware attacks and bitcoin miners in MacBooks recently -- they got tired of Windows now lol, Youtube seems to be in attack lately too with increased Russian spams and sudden 2FA alert to users. I'm just not sure if it's connected to cryptocurrency manipulation or more likely the upcoming US Presidential election)

- cold cash (stored in secure vaults not stored in plastic cards or under your pillows)

Back to Top

Featured image by S. Pollock of Unsplash.

0 comments:

Post a Comment