FX Trading Ideas for the Week | Feb 10 - Feb 14, 2020

Trump recently proposed this year's US budget, cutting dollars in discretionary funding such as foreign aid and environmental protection, while boosting the budget on defense and homeland security, with increasing total taxes and social security amounts (hopefully from an increasing workforce instead of individual tax rate) expected to significantly help reverse the ballooning deficit.

|

| Proposed Budget for 2021, net of adjustments Source: whitehouse.gov |

|

| Discretionary figures here don't include contingencies, emergency and other adjustments (hence lower amount from above). Source: whitehouse.gov |

|

| Source: defense.gov |

Its main aim is to protect American interests and maintain its current dominance in terms of government expenditure on space, as governments of other main players were rumored to increase their space funding too (except Russia probably) in preparation for the planned lunar and asteroid mining.

Given current NASA budget vs its 2018, figures for 2020-2021 are more or less near the figures presented by India's 2019-2020 economic survey below:

|

| Source: indiabudget.gov |

|

| Source: rferl.org |

Anyway, maybe it's somewhere here (and I've probably just missed it):

|

| Source: National Bureau of Statistics of China |

Given that their average Defense expenditure per year is around half of the US military's, for simplification purposes, given NASA's average budget per year from 2018-2021 is $19.5-25.2, probably China's CNSA budget is around $9.75-12.6 (given China's aggressiveness, it could be higher. But considering the current corona virus issue now, it could be lower).

Europe's ESA budget for 2020 is 6.68 billion euro or around $7.29 billion. While India is at around $1.88 billion (after converting rupee amount below in its current exchange rate).

|

| Source: indiabudget.gov |

I haven't double-checked Russia's Roskosmos, which is another major player in this space thing. I'm too scared to go to their site after my antivirus gave me this warning:

Considering how close the 2020-2021 figures are in the diagram from Rferl above, let's just say Russia is at around $2.5-4 billion, while the rest are trailing behind Russia.

What's the point?

For now, none.

Lol.

I'm just fascinated with the competition, and I like aligning my long-term trading strategy with long-term global market trends.

In the long-run, this might give us a hint in advance who's going to dominate the next era -- which is a total game-changer. Though it's not automatically the one with the consistent biggest government budget for space because of a lot of factors, it's still an advantage especially when it comes to bargaining power and negotiations.

Though the corona virus outbreak now might turn out to be the trigger of the recession rumors circulating around (since the bond inversion fears back in 2018), especially with:

1. more flights to China being canceled until late mid-Spring this year, and

2. fumigation to counter the spread of corona virus locally increases risk of chemical toxicity which in general is also an investment risk being overlooked in the short to medium-term

Both of these might probably cause a 10-20% correction in the markets (I don't know for how long if ever), before markets recover as the AI and space era starts to gain momentum.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Buy (short-term)

Though based on AUD pairs price action and technicals, there's possibility of short-term recovery this week after the US-China trade spats and recent wildfires pushed them down further, need to be extra careful still because of the corona virus risk mainly affecting Australia's main trading partner China, with number of deaths now reaching 1,000.

AUDCHF - Ride short-term rally up to 0.67 or wait for probably bearish continuation after rally

AUDJPY - Wait near 73

AUDNZD - Ride possible rally up to 1.06-1.07

AUDUSD - Wait for confirmation of bullish reversal first then buy near 0.67

EURAUD - Wait for confirmed bearish reversal near 1.66

GBPAUD - Wait for either possible extended move up to 2.00 psychological level then sell or confirmed bearish reversal at 1.91

CAD - Wait

Though there's a slight possibility for oil to rally soon since it's already oversold by now, must wait for confirmation of reversal first before going bullish on both oil and CAD since the corona virus is still causing the markets to be risk-off (which is generally all the more bearish for oil), unless there's assurance that it's being managed better soon, or a confirmed vaccine or cure is on its way.CADCHF - Wait for better entry near 0.74 before selling or continue selling up to 0.718

CADJPY - Wait near 82

EURCAD - Wait for bounce back at 1.45 then buy

GBPCAD - Wait for recovery near 1.74 then sell

NZDCAD - Ride bearish continuation up to 0.83-0.84 before counter-trend buying

USDCAD - Wait for better entry near 1.35 then sell

AUDCAD - Buy at 0.885-0.89

CHF - Buy

Given the general risk-off sentiment of the markets as also mentioned in this month's FX seasonality, still bullish overall for CHF.CHFJPY - Wait for better entry near 111.5 then buy up to 114.5-115

EURCHF - Wait for either short-term rally to 1.08 or bearish continuation from 1.064 before selling up to 1.032

GBPCHF - Wait for short-term rally at 1.277 then continue selling

NZDCHF - Wait for confirmed bullish reversal near 0.62 then counter-trend buy

USDCHF - Wait for direction confirmation at 0.98

AUDCHF - Ride short-term rally up to 0.67 or wait for probably bearish continuation after rally

CADCHF - Wait for better entry near 0.74 before selling or continue selling up to 0.718

EUR - Buy (short-term)

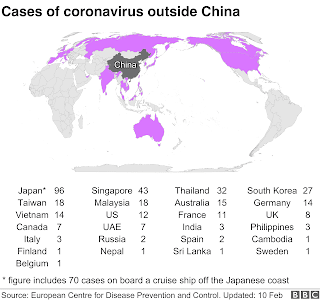

The worse than expected German factory orders and industrial production numbers prevented EUR in recovering from its oversold levels despite Germany's usual trade surplus. Though it's possible for EUR to rally and bounce back soon, better to wait for confirmation first especially the corona virus has now spread to the Eurozone as well.As of yesterday, these are the confirmed cases now outside China:

|

| Source: BBC, European Centre for Disease Prevention and Control |

Let's see how EU's economic forecast and GDP figures go this week.

EURGBP - Wait for bullish reversal near 0.83-0.84 then buy up to 0.86

EURJPY - Wait for consolidation near 118.5 before counter-trend buying

EURNZD - Wait near 1.71

EURUSD - Wait for confirmed bullish reversal near 1.08-1.086 before buying

EURAUD - Wait for confirmed bearish reversal near 1.66

EURCAD - Wait for bounce back at 1.45 then buy

EURCHF - Wait for either short-term rally to 1.08 or bearish continuation from 1.064 before selling up to 1.032

GBP - Sell

With BoE holding rates at 0.75% last month right after Carney's last monetary policy meeting and before Bailey replaces him a month from now, markets continue to price in the expected slower growth of UK after Brexit and the uncertainty regarding its post-Brexit trade negotiations with EU.Corona virus fears also spread to the UK, especially as this British businessman (dubbed as a super spreader as he infected at least 11 people by now) came back from his sales conference in Singapore attended by an infected person from Wuhan, and is now quarantined in London.

GBPJPY - Wait for possible rally to 143-145 then counter-trend sell

GBPNZD - Wait for possible rally near 2.05 then counter-trend sell

GBPUSD - Either ride possible rally up to 1.33 and then sell near there, or wait for bearish continuation past 1.275

EURGBP - Wait for bullish reversal near 0.83-0.84 then buy up to 0.86

GBPAUD - Wait for either possible extended move up to 2.00 psychological level then sell or confirmed bearish reversal at 1.91

GBPCAD - Wait for recovery near 1.74 then sell

GBPCHF - Wait for short-term rally at 1.277 then continue selling

NZD - Wait

Unlike EUR and AUD which are mainly at oversold levels now and could have rallied sooner if it weren't for the corona virus, NZD is a mixed bag. RBNZ is most likely to hold its current interest rate at 1% tomorrow though instead of having a rate cut -- similar to RBA holding its current rate at 0.75% last week and hinting of waiting for last year's 3 cuts to take full effect this year instead of providing more stimulus.NZDJPY - Wait for bearish continuation past 70 then sell up to 68.5

NZDUSD - Continue selling up to 0.625-0.63 or wait for bullish reversal confirmation around that area

AUDNZD - Ride possible rally up to 1.06-1.07

EURNZD - Wait near 1.71

GBPNZD - Wait for possible rally near 2.05 then counter-trend sell

NZDCAD - Ride bearish continuation up to 0.83-0.84 before counter-trend buying

NZDCHF - Wait for confirmed bullish reversal near 0.62 then counter-trend buy

JPY - Wait

Despite Japan having the most number of confirmed corona virus cases outside China, bearish FX seasonality for this month, consistent bearish trend on JPY (bullish for its pairs) below, and accomodative BOJ, best to wait for confirmation first and trade JPY pairs more carefully especially since JPY is generally treated as safe haven like CHF during markets are risk-off.USDJPY - Wait for direction confirmation near 110

AUDJPY - Wait near 73

CADJPY - Wait near 82

CHFJPY - Wait for better entry near 111.5 then buy up to 114.5-115

EURJPY - Wait for consolidation near 118.5 before counter-trend buying

GBPJPY - Wait for possible rally to 143-145 then counter-trend sell

NZDJPY - Wait for bearish continuation past 70 then sell up to 68.5

USD - Wait

DXY recovered higher than I expected during the early part of this month (despite its bearish seasonality bias for February), because aside from way better expected NFP figures last week, Trump's $4.8 trillion proposed spending for 2021 above aims to provide enough stimulus to achieve higher GDP. However, since Trump actually wants a weaker USD overall to reduce its deficit and make American exports more competitive, and current weekly price action is beginning to show a flatter trend, best to wait for further confirmation and trade according to other currency's strength instead.

AUDUSD - Wait for confirmation of bullish reversal first then buy near 0.67

EURUSD - Wait for confirmed bullish reversal near 1.08-1.086 before buying

GBPUSD - Either ride possible rally up to 1.33 and then sell near there, or wait for bearish continuation past 1.275

NZDUSD - Continue selling up to 0.625-0.63 or wait for bullish reversal confirmation around that area

USDCAD - Wait for better entry near 1.35 then sell

USDCHF - Wait for direction confirmation at 0.98

USDJPY - Wait for direction confirmation near 110

XAUUSD - Wait for confirmed short-term bearish reversal at 1580-1585 before selling up to 1515

XAGUSD - Continue selling up to 16.5-17

XTIUSD - Buy near 49 up to 53.5-55.5

USDZAR - Sell at 15-15.5 up to 14-14.33

USDMXN - Wait for possible rally to 19

USDCNH - Wait near 7-7.05

Featured image by Bill J. of Unsplash

0 comments:

Post a Comment