FX Seasonality Forecast for February 2020

Markets starting to gain their momentum (and sanity) back after the inauspicious start of the Metal Rat year.

|

| Tai Sui now moved to the North, while the 3 killings are now at the South...wait, wrong blog.😝 |

Trump also delivered his State of the Union Address-- the main thing I've been waiting for (next to Brexit aftermath) hence, I avoided making any major trades (only small automated ones with my EA) and posting here early.

This is potentially his last, unless he gets re-elected on November this year after emphasizing the US-China phase 1 trade agreement, changing NAFTA with USMCA, lower unemployment, promising more economic growth, and basically protecting American's freedom against socialism.

Being pro-capitalism, the latter sounds promising (even if I'm not American-- whatever happens in that country usually trickles down to mine), and quells fears against universal basic income that in theory seems ok and reasonable once AI takes majority of people's jobs, but in reality, sounds similar to comms ideology to me.

Regardless, imho the major players in the global markets like US, China, Euro zone and Japan stand on shaky grounds with lower GDP over time, higher debt, higher trade deficit for some (not applicable to China and Germany so if worse comes to worse, they'll bounce back faster), and lesser power (and influence) of central banks to save the economy like in the past because of lower interest rates.

Moderate increase in US consumer confidence, promising German manufacturing PMI last month, any positive news regarding US-China phase 2 trade deal, and possible boost in GDP thanks to new AI-driven tech like electronic cars or the planned modern railroad system in Germany, might prevent global economy from spiraling into recession, and if ever, just experience a short-term correction.

If global economy can't rise further from its current state mainly because of uncertainties regarding trade deals, with most whales being risk-off hoarding cash instead of being willing to invest on growth and production like before, I'm with Ray Dalio on this one-- actually we're possibly already in the beginning stages of an upcoming decade-long recession.

TABLE OF CONTENTSI. Outcome of FX Seasonality-Based Prediction for January 2020II. Forecast for February 2020 Based on Recent 10-Year FX Seasonality |

I. Outcome of FX Seasonality-Based Prediction for January 2020

Majors and crosses moved within the expected range last month-- except for comdolls which dropped faster against the dollar (despite DXY not rallying higher outside the expected range after the US-China phase 1 deal).Attributing the comdolls' slide on the initial effects of the phase 1 trade deal (tariffs still there), sudden drop in oil (which caught me by surprise initially, but considering how risk-off the markets are, perfectly understandable now), and general market impact of the corona virus.

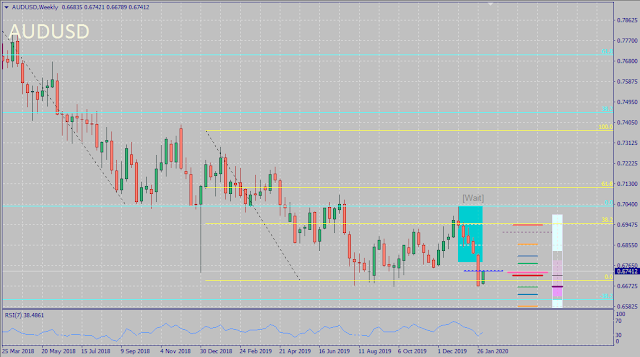

AUDUSD

EURUSD

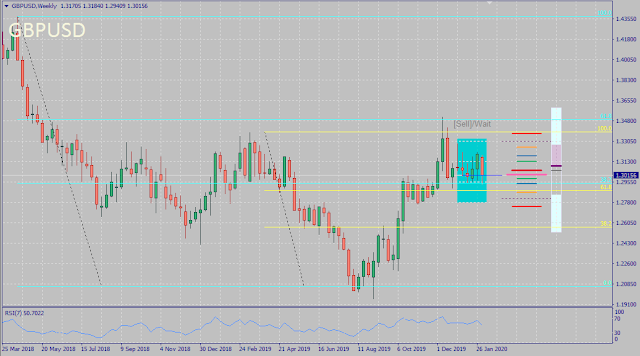

GBPUSD

NZDUSD

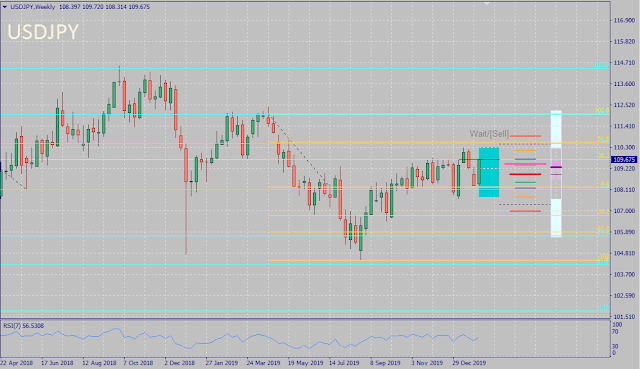

USDJPY

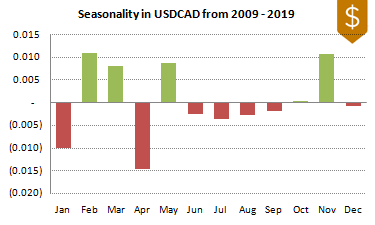

USDCAD

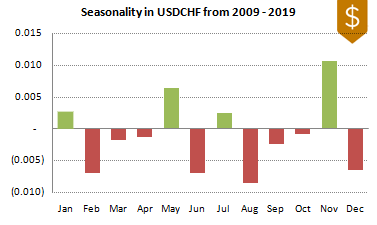

USDCHF

USDMXN moved within its forecasted range. However both South African Rand and Chinese Yuan didn't handle the virus well (I've gotten too way ahead in USDCNH though).

USDMXN

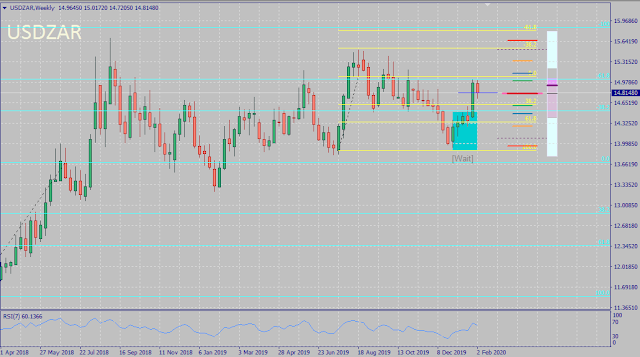

USDZAR

USDCNH

II. Forecast for February 2020 Based on Recent 10-Year FX Seasonality

Despite with Brexit, State of the Union Address, some PMI and interest rate news now out of the way, and corona virus anxiety starting to wane by now, markets haven't really gained back its risk appetite and continue its general risk-off sentiment.DXY

AUDUSD

EURUSD

With higher than expected German PMI and rumors about expanding its economy by investing 62 billion euro on new public infrastructure -- primarily its railroad system, as well as a moderately bullish bias on its February seasonality, expecting EURUSD to slightly recover soon (if not finally start reversing up).GBPUSD

Though fundamentally-speaking, the pound is bound to go further down post-Brexit-- especially after the current transition period if UK and EU don't agree to a trade deal, it's highly probable that BoE and UK government will provide some easing to prop their economy up (and might lead to a double-top in GBPUSD's weekly chart below). It's also possible that the pound's recovery might come from this great news about corona virus vaccine.NZDUSD

USDCAD

USDCAD rose earlier than expected in its seasonality because of the slump in oil due to general risk-off sentiment thanks to the corona virus. But the virus fears are waning though so either it might suddenly reverse its rally later this week (after US PMI or employment news), or touch 1.34 first before doing so.USDCHF

USDJPY

Almost same logic as with USDCHF above-- but to a lesser extent because of BOJ ready to provide easing any time soon.USDMXN

Expecting this pair to go ranging based on this month's seasonality, and possibly slide down to 18.3 later this month especially if DXY drops as expected too.USDZAR

Based on this month's seasonality, DXY trend and overall slump of ZAR, expecting USDZAR to continue moving its current range (with short-term bearish bias).USDCNH

First time to analyze seasonality of USDCNH (only starting 2012, so just 7 years instead of the usual 10). Only gave me 58% win-rate (not surprised considering how Chinese Yuan is pegged to the US dollar instead of allowing it to freely float like most other currencies). So will refer to DXY seasonality too when analyzing this pair.Back to Top

Note: Analysis for S&P 500, Metals & Oil will be in another post later (as mentioned in last month's seasonality).

Featured photo by W. Hicks of Unsplash, Cheeki Breeki photo by DrJorus, Flying Stars by Unlock Arcana.

0 comments:

Post a Comment