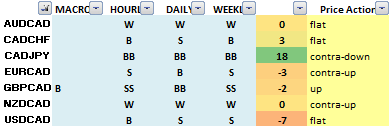

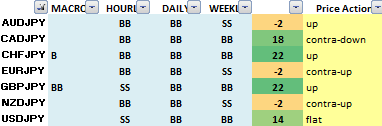

FX Trading Ideas for the Week | Oct 21 - Oct 25, 2019

Halloween isn't the only thing I'm waiting for.

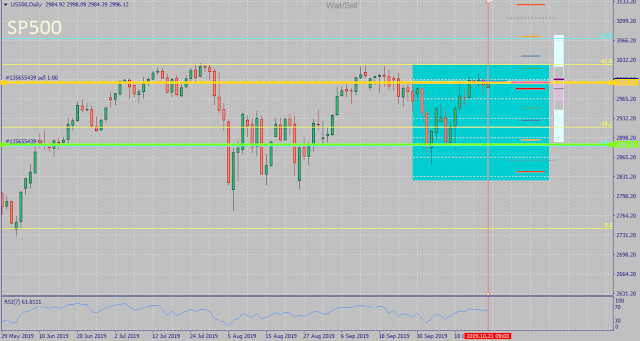

A bit disappointed that USD bounced down earlier than I thought though--- I was expecting it to move and finally tippity-touch the 100 psychological resistance but it oopsie'd and went the other way instead.

Anyway, though a rally is most likely due at this point after markets already priced in another Fed rate cut by December this year, need to be weary of DXY's current price action particularly that huge bearish candle last week and the "rumors" that the Fed is somewhat being coerced to go to sub-zero interest rate territory, with its members expressing concern that the markets seem to be expecting the Fed to balk and give in to Trump's threats to lower rates more than they're actually willing to do-- in connection to recession fears and boosting competitiveness of USD against the Chinese Yuan.

US and China are back to their truce, with possible trade "negotiations" by mid-November. Markets have now shifted focus to Canadian elections and Brexit.

Before you proceed, make sure to read and understand this Disclaimer here and TRADE AT YOUR OWN RISK.

I. FX Trading Ideas for the Week

AUD - Buy (short-term)

Ride the recent better than expected trade balance figures in China and US-China current trade truce. China is also low-key retaliating against Trump by buying soybeans from Brazil instead. Australia also enjoyed better than expected unemployment figures which seem to encourage the RBA to delay its planned 25bps rate cut next month to December (possibly to ride the Fed's next cut too)-- which imho is already priced in by the markets.

AUDCAD - Wait near 0.90

AUDCHF - Wait for better entry near 0.65 before buying

AUDJPY - Wait near 75

AUDNZD - Wait near 1.07

AUDUSD - Wait near 0.69

EURAUD - Wait for possible rally to near 1.65 again before selling

GBPAUD - Short-term sell to ride possible consolidation from 0.90

CAD - Wait

Though I'm generally bullish both in oil and CAD, best to wait for Canada's election outcome first. Tbh I'm not very familiar with Canadian politics, but this is an interesting primer about them.CADCHF - Wait near 0.75

CADJPY - Wait near 82.5

EURCAD - Wait for bullish continuation past 1.47 then buy again

GBPCAD - Wait for reversal/consolidation from near 1.75

NZDCAD - Wait near 0.84

USDCAD - Wait near 1.30

AUDCAD - Wait near 0.90

CHF - Wait

Expecting CHF to consolidate a bit after its recent bullish movement last week, riding the USD weakness and current truce between US-China trade "talks".CHFJPY - Wait near 110

EURCHF - Wait near 1.10

GBPCHF - Wait near 1.30

NZDCHF - Wait near 0.63

USDCHF - Wait near 0.985

AUDCHF - Wait for better entry near 0.65 before buying

CADCHF - Wait near 0.75

EUR - Wait

Despite the markets being more focused on Canada and Brexit this week, still best to wait for PMI news and ECB conference on Thursday before riding the possible short-term rally on EUR this week.EURGBP - Wait near 0.86

EURJPY - Wait near 121

EURNZD - Wait near 1.75

EURUSD - Wait near 1.11

EURAUD - Wait for possible rally to near 1.65 again before selling

EURCAD - Wait for bullish continuation past 1.47 then buy again

EURCHF - Wait near 1.10

GBP - Wait/Sell (short-run)

So Boris has been forced to delay Brexit thanks to the Benn and Letwin law, but if he finally manages to convince the MPs to amend existing deal and vote for an "agreeable" soft-Brexit deal by tomorrow, then an October Brexit is still in the table. This will cause pound to start moving sideways. However, if an extension to 2020 is still the more likely scenario, expecting pound to continue its recent bullish momentum (after a short-term consolidation this week).GBPJPY - Wait near 140.5

GBPNZD - Short-term sell to ride possible consolidation from 2.05

GBPUSD - Wait near 1.30

EURGBP - Wait near 0.86

GBPAUD - Short-term sell to ride possible consolidation from 0.90

GBPCAD - Wait for reversal/consolidation from near 1.75

GBPCHF - Wait near 1.30

NZD - Buy (short-term)

With an underrated New Zealand economy (its positive outlook simply being hampered by its government), current US-China trade truce, and markets already pricing in RBNZ's rate cut soon (after RBA's cut this coming December), expecting the Kiwi to slowly enjoy some short-term rally at least, though based on its October seasonality, Kiwi still most likely to remain bearish overall in Q4 this year.NZDJPY - Wait near 70

NZDUSD - Wait near 0.64

AUDNZD - Wait near 1.07

EURNZD - Wait near 1.75

GBPNZD - Short-term sell to ride possible consolidation from 2.05

NZDCAD - Wait near 0.84

NZDCHF - Wait near 0.63

JPY - Wait

Yen seems oversold overall by now, so it's less likely for yen pairs to resume last week's momentum (more likely for them to start going range-bound this week unless S&P 500 starts falling down again or some other sign of recession begins-- all pretty bullish for JPY in general as a traditional safe-haven currency.)USDJPY - Wait near 108.5

AUDJPY - Wait near 75

CADJPY - Wait near 82.5

CHFJPY - Wait near 110

EURJPY - Wait near 121

GBPJPY - Wait near 140.5

NZDJPY - Wait near 70

USD - Wait

As mentioned earlier, best to wait for confirmation first in USD for now.AUDUSD - Wait near 0.69

EURUSD - Wait near 1.11

GBPUSD - Wait near 1.30

NZDUSD - Wait near 0.64

USDCAD - Wait near 1.30

USDCHF - Wait near 0.985

USDJPY - Wait near 108.5

XAUUSD - Wait near 1490

XAGUSD - Wait near 17.5

XTIUSD - Wait for bullish confirmation past 55 or consolidation at 51 or lower before buying

USDZAR - Wait near 14.7

USDMXN - Wait for possible rally soon near 19 and counter-trend buy

0 comments:

Post a Comment