FX Seasonality Forecast for October 2019

Though US-China trade talks will happen again some time mid-October, markets doubt that it will create a peaceful negotiation to remove existing tariffs in place. Either it might simply create a truce that might postpone the planned December tariffs to next year, or escalate current trading tensions-- which is less likely given that the POTUS is currently dealing with a new round of impeachment inquiry

Imho, I don't think he'll get impeached (unless they freeze all his money first maybe), or even if he gets impeached, he'll be acquitted.

I know very little about US politics though-- as if I care. Again, I'm just here for the pips lol. I don't even care much about our local politics either. It's against LOA rules which I try my best to strictly adhere to now because I get great luck whenever I do so, and I get unlucky when my mental state goes down the same level as those evening news and people who constantly complain in life.

Anyway, it's more likely that the markets are tired of the US-China tensions by now and expect no improvement, so they'll focus more on the next Brexit developments. The delay to January 2020 is currently being priced in whether Boris likes it or not and regardless of how much he yelps in pain, especially after the parliament suspension he requested from the Queen was deemed unconstitutional by the UK Supreme Court.

But who knows? Maybe Boris will indeed deliver a no-deal Brexit this month especially after the Court of Appeals in Belfast (a Northern Irish court) gave Boris some ammo after rejecting the case that no-deal Brexit violates the Good Friday Agreement. But the MPs will do everything they can to avoid a no-deal Brexit by either: asking some "assistance" from the Scottish Nationalist Party for Corbyn (who is willing to delay Brexit) to replace Boris as an interim PM, or revoking Article 50 altogether.

I. Outcome of FX Seasonality-Based Prediction for September 2019

Prices moved within the expected range for September, however both AUD and NZD seem to have a strong support at the 0 fibonacci level despite the expected rate cut by RBA and RBNZ by October, so they were less bearish as expected.GBP pairs moved up instead of the expected bearish bias in its September seasonality because of the "rumor" about postponing Brexit and moving it from this month to January next year, thanks to Operation Yellowhammer fears particularly regarding the Northern Ireland border issue which the EU itself wants to avoid.

EUR pairs on the other hand slid down instead of recovering up as predicted in its seasonality last month right after another round of quantitative easing amidst low production fears in Germany and uncertainties regarding the US-China trade tensions.

Other pairs and assets also moved within the target seasonality range last month, except for silver which was still more volatile than expected, and exotic currency pairs not moving up quickly as anticipated because of the muted USD reaction to the Fed's "hawkish" rate cut last September 18.

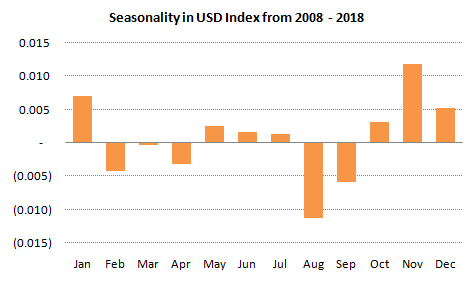

II. Forecast for October 2019 Based on Recent 10-Year FX Seasonality

Overall, expecting the markets to resume its risk-off stance soon especially after confirmed reversal in the S&P 500. The USD may or may not breach the 100 psychological resistance, but some whales are considering it as safe haven currency again too (as part of their cash-hoarding recession proofing), just like CHF and JPY.DXY

Expecting DXY to continue going up but move in tighter range as it continues to test the 61.8 fib level at 99.45 with the aim of breaking past it and finally touching that 100 psychological level.

I don't have any audit data regarding why US banks (and even our local banks here) are having cash shortage now-- I suspect it's because of recession fears so the whales have started hoarding cash which also boosted profits of storage units companies.

So the Fed recently addressed the banks' liquidity issue by injecting funds in the financial market through overnight repurchasing agreements or repo loans, similar to what it did in the markets during the 2008 financial crisis.

This Fed's stimulus mainly helped pushed the dollar up recently after its muted response to the September rate cut.

I don't have any audit data regarding why US banks (and even our local banks here) are having cash shortage now-- I suspect it's because of recession fears so the whales have started hoarding cash which also boosted profits of storage units companies.

So the Fed recently addressed the banks' liquidity issue by injecting funds in the financial market through overnight repurchasing agreements or repo loans, similar to what it did in the markets during the 2008 financial crisis.

|

| Source: New York Fed |

This Fed's stimulus mainly helped pushed the dollar up recently after its muted response to the September rate cut.

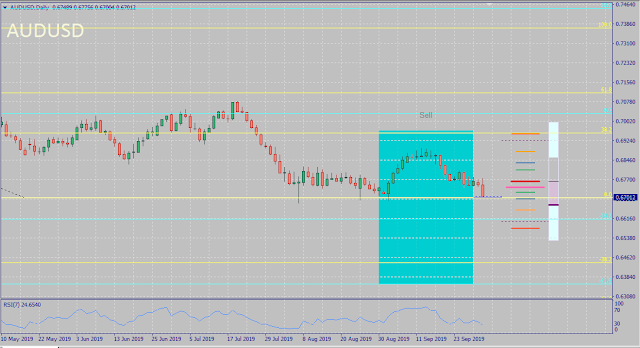

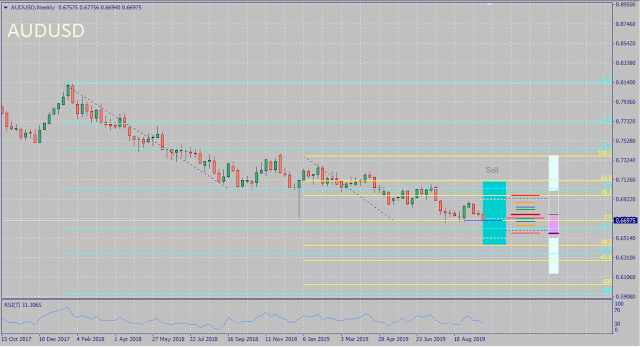

AUDUSD

The 0.67 0-fibonacci level resistance continues to be tested while markets already priced in RBA's recent 25 bps cut. Based on this month's seasonality, it's more likely that the bearish trend will continue. However, based on price action and how strong that current 0.67 resistance is, it's highly likely that AUD will recover a bit first especially after China reported better than expected PMI figures yesterday.Trump is cooking up some plans to reduce capital outflows to China by delisting Chinese companies from US exchanges which has negative impact not only on Chinese Yuan but on Australia as well. It's still uncertain whether this will come to fruition or not, but add the next round of tariffs on Chinese electronics this coming December plus the unresolved Hong Kong protests, and of course the seasonality below support a bearish bias in AUD not only for this month but for the whole Q4 2019.

EURUSD

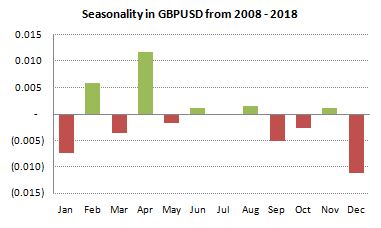

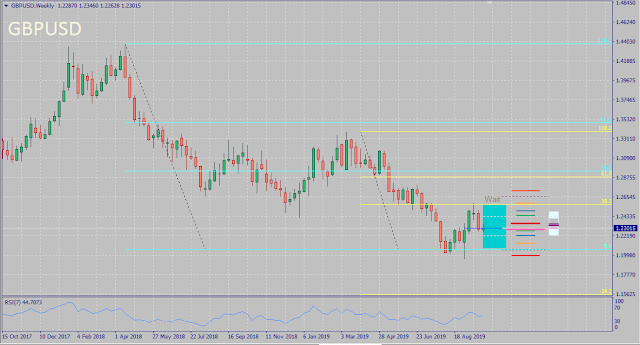

Based on its seasonality, expecting EURUSD to recover a bit this month before possibly continuing its bearish slide down to 1.077 (-100 fib level resistance) or even lower by end of this month especially after the ECB relaunched its quantitative easing program once more, with no particular deadline in sight.GBPUSD

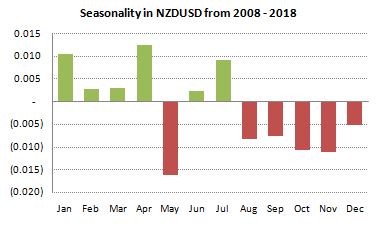

Aside from the less defined directional bias on this pair's October seasonality below, considering the Brexit drama mentioned above, it's more likely for the pound to get wishy washy and stay range-bound for the most part this month until another Brexit delay or no-deal Brexit is confirmed.NZDUSD

The Kiwi continues to be underrated because it's usually seen as a "shadow" of the Aussie. Despite the bearish bias on its seasonality for the latter part of the year and recent slump in business confidence, expecting it to slide up to 0.595 at most (more probable to bottom now at 0.625) before finally recovering since imho New Zealand's economy and trades are more resilient than Australia's.IMF even sees New Zealand's economic expansion as pretty solid, and Moody's continue to give it an AAA credit rating after assessing its fiscal strength.

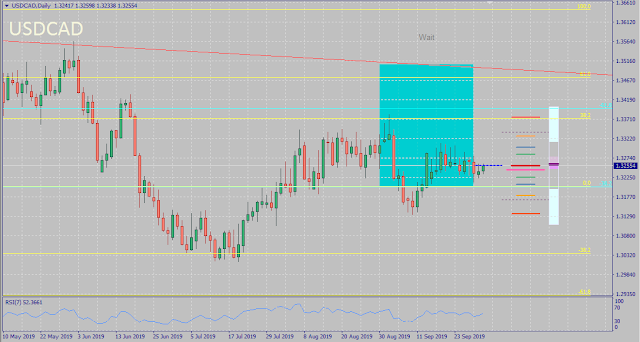

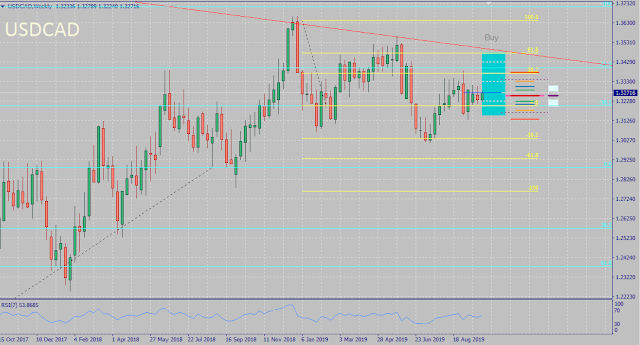

USDCAD

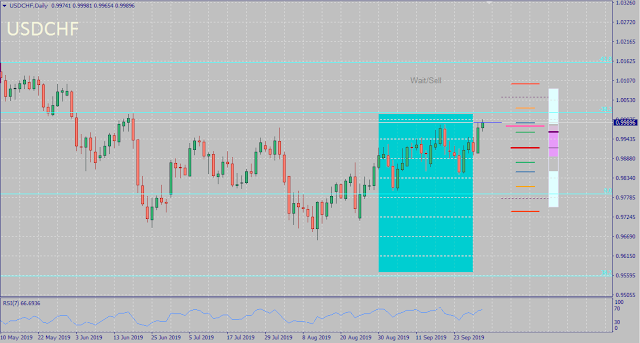

Its seasonality for this month, the recent slide in oil to close the gap created right after the Aramco attack, negative impact of US-China trade spats on CAD, and the push in DXY to reach 100 create a bullish bias on USDCAD (at least up to 1.35).USDCHF

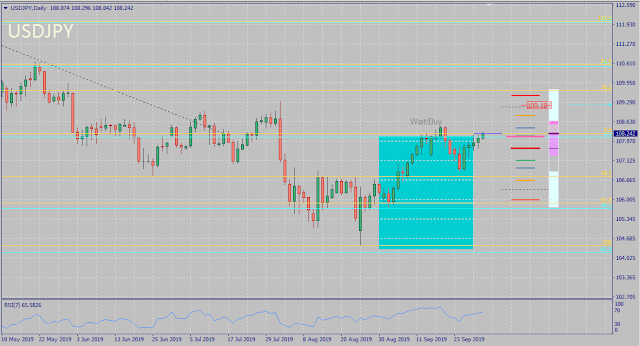

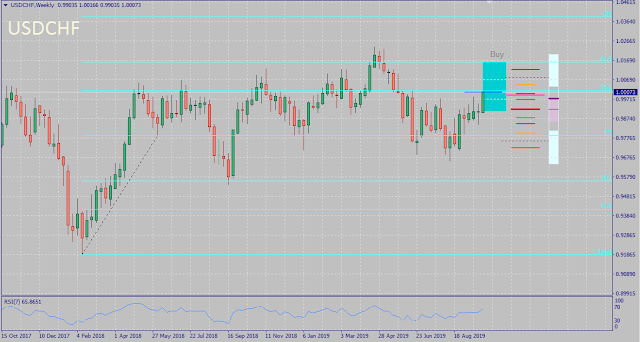

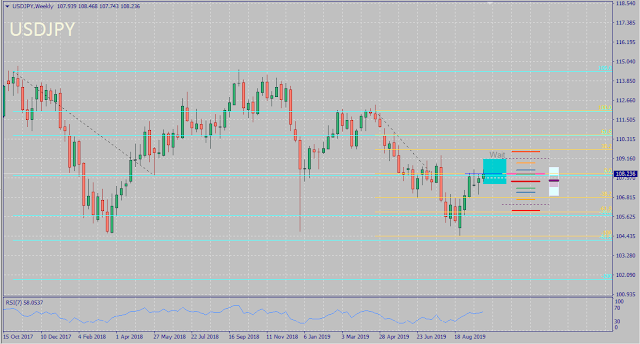

The recent appeal of rising US dollar after the Fed's repo and Trump's impeachment inquiry, as well as its seasonality for this month give USDCHF bullish bias. But most likely it will just touch 1.00 before going ranging, or rise up to 1.015 at most (61.8 fib) before bouncing down again especially if confirmed reversals happen both in DXY (at around 100 psychological resistance) and S&P 500 (at around 3000)-- with the latter seem to be happening already by now as well as Asian stocks due to manufacturing weakness.USDJPY

Expecting USDJPY to move in a tighter range this month (and next) as the yen moves in tandem with the appreciating USD because of the lack of confirmation from BOJ whether they will go further down the negative rate territory and joining the EU and Australia in cutting rates again, as well as the recent additional 10% sales tax imposed in Japan.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for October 2019

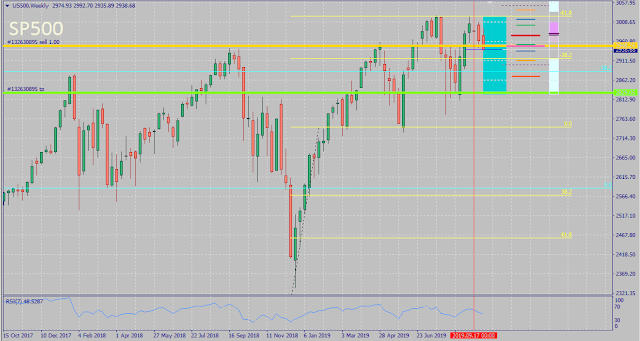

S&P 500*

Still having a bearish bias as last month especially it continues to simply touch but not break the 61.8 fibonacci level near 3000. The divergence in RSI and that seemingly double-top chart pattern in the weekly chart, together with risk-off markets and dismal global manufacturing figures all point to at least a consolidation, if not a downright crash, in S&P500 soon.

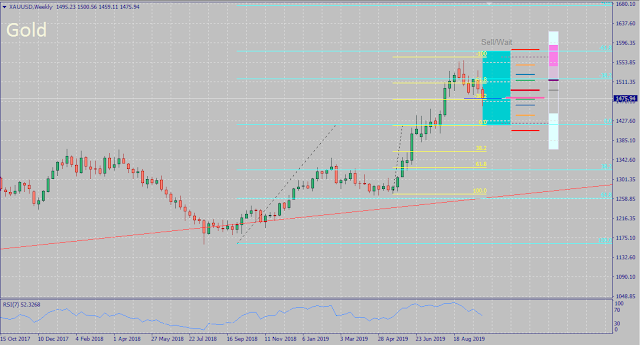

Gold*

Despite the bearish bias in its seasonality this month, based on those wicky bearish candles, price action, risk-off market sentiment and overall fundamentals, it's more likely for gold to recover soon-- if not from 1475, probably after touching 1420 again soon.

Silver*

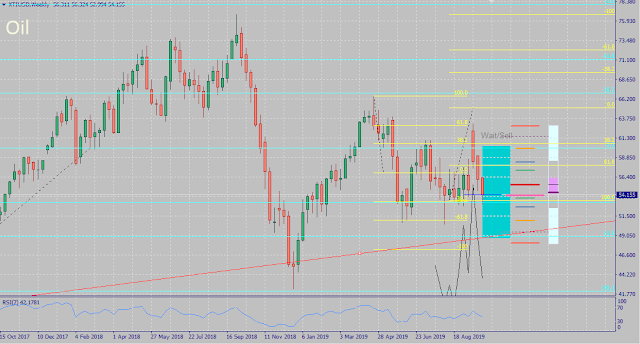

Like gold, despite its bearish bias in this month's seasonality, it's more likely to recover soon-- either reversing at its current support at 17.25 (0 fibonacci level in weekly chart) or somewhere lower (the next support around 15.80 (38.2 fibonacci level in weekly, and 0 fib level in daily chart).Oil*

Despite its bearish bias in October seasonality, oil had finally closed the gap it created after the Aramco attack and might be bound to recover soon as well around 53 (100 fibonacci level in daily chart). Most likely oil will go ranging between 55-60 afterwards, but giving it some lee-way to possibly reverse at the 61.8 fibonacci level in the weekly chart instead considering the recent strength in USD and upward monthly trendline.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

Feature image by Sunyu of Unsplash

0 comments:

Post a Comment