FX Seasonality Forecast for August 2019

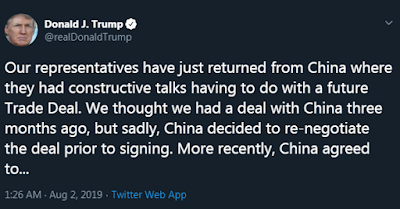

With Trump tweeting last Thursday about imposing a 10% tariff on China starting on September 1 this year, gold continues climbing and now at its all-time high since 2013, while finally getting what he wants: weaker USD.

The effect of rising DXY after less than Dovish comments by Powell last Wednesday had started reversing after Trump's tweets, and this Monday the panic began after the market fully digested the recent US-China trade "talk", hinting the probability of a recession in less than a year.

With that said, though I still remain long on gold (probably until 1500-- but may extend up to 1800, we'll see..), I have to get emotionally ready to part with it in the near future, including some jewelry, if a recession indeed happens *knocks on wood*.

I have to thank Princess Mendoza here. I've been following her channel for some quite time and very grateful for the info she shared about where to buy legit gold jewelry locally, why Platinum isn't a good "investment", and which type of gold is better, among other things.

Of course I don't want a recession still, all the repercussions are unpredictable and I'm not ready to do the full Grayman Lifestyle just yet (hello boring Uniqlo clothes. If I'm a guy, that won't be an issue. We ladies always want to standout in a crowd like a celebrity, and secretly compete with each other -- but without going overboard and risk looking like a th*t. Contrary to what most people think, women don't really compete for guys' attention [unless you're single maybe, hmmm #cantrelate]. We just generally compete for approval from others, like who's the better influencer in different spheres like beauty, fashion, events, wits, etc.).

But adopting some Grayman skills as early as now won't hurt either especially it takes time to really make them 2nd nature. It's like what I should have learned in Girl Scout but didn't because all I remember doing back then was wear its uniform, hold the flag for my group and attend pointless meetings.

I. Outcome of FX Seasonality-Based Prediction for July 2019

DXY continued rising, contrary to what I expected (bounce down to 93 from around 98, which is the previous 100 fib level), until last week where it formed the shooting star candle right after Powell and Trump.Given the highly bullish non-commercial traders (speculators) in the COT futures report, it's highly probable that DXY will only experience a short-term correction and will still try to hold this flag until it touches the 100 psychological resistance before plunging down near 90 by early next year even after Trump's term, especially if US-China trade talks get worse.

|

| Sometimes it's pointless to check this calendar. Better follow the chatroom drama lol. |

|

| Ikr. |

The majors moved within last month's forecasted range, except for AUDUSD which became more bearish as expected (when is this pair actually planning to bottom?), and EURUSD which didn't slide down further as I initially expected.

I suspect some strong bullish whales hiding, especially there are probably some old money Brits treating EUR as safe haven and exchanging their cable to fiber esp after UK elected a new PM. Germany probably wants the pound devalued as well like back in the 90s when Soros broke England.

So I thought EUR already bottomed, closed my remaining bearish positions during the latter part of July and finally joined the bulls.

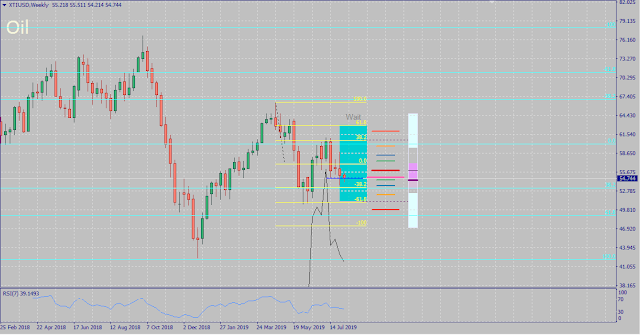

Both oil and mexican peso disappointed by staying muted instead of getting stronger in July despite agreed oil production cuts during the latter part of 2019 (maybe I have to wait until the -ber months when it's starting to get cold before going bullish again on them, as well as in CAD, because the current trade talks are pushing them down like CNY).

I expected S&P 500 to stay range-bound which it kinda did except after Trump's tweets above. Same expectation with metals, but whales there are so awake (maybe some of them are part of these folks expecting a crisis which I mentioned in last month's seasonality), hence the metals finally jumped higher (I've been waiting for that significant rise to happen since Q1 this year, they've been always late to react until recently).

II. Forecast for August 2019 Based on Recent 10-Year FX Seasonality

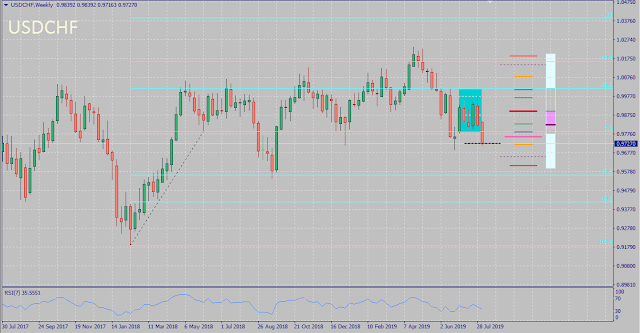

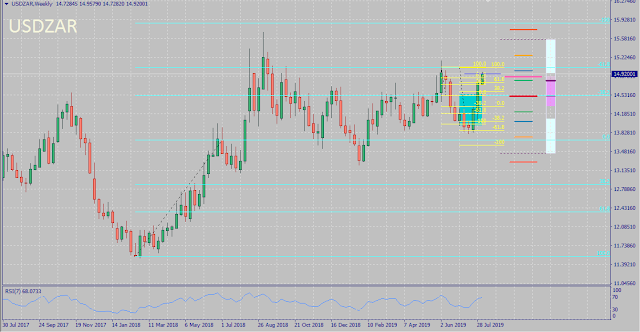

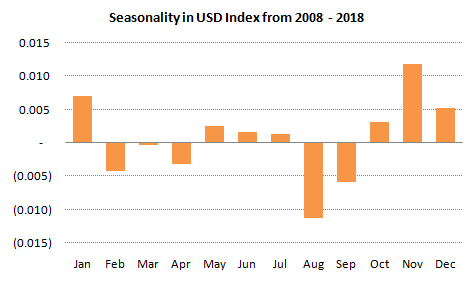

Overall I'm expecting the currencies to reflect a USD correction -- except for AUD and NZD since the devaluation on CNY largely impacts the Aussie, and to some extent, the Kiwi too. EUR pairs will most likely continue to rise, while GBP pairs may either go muted/ranging after the recent drop.DXY

As mentioned above, DXY futures speculators remain highly bullish in USD despite being overbought. What's interesting though is the slightly bigger total short position compared to long, at least as of July month end. Let's see on Wednesday once Aug 6 data is released if it's still net short.

Usually when this happens, I gain by being contrarian and trading opposite the majority of speculator's position and also retail traders (non-reportable), especially when DXY's seasonal pattern for August (for the past 10 years) is also bearish.

Need to watch out for the possibility of an early recovery though esp the retail bulls are so loud in the chat. DXY might peak near or @100 by November this year, before reversing by mid-to-late Q1 next year.

AUDUSD

Contrary to what I expected last month, the Aussie didn't recover from being oversold but simply bounced down from around its 0.70 resistance. Based on its seasonality for the upcoming months, as well as the new 10% tariff slapped by Trump on China, expecting AUDUSD to rally a bit up to 0.69 while DXY is also down, before continuing its bearish momentum.EURUSD

As mentioned above, and also looking at this month's chart and seasonality for EURUSD, its seems like its forming a bowl pattern and though there's possibility of this going range-bound in the short-run, it's highly likely that it will continue the recovery it started last Thursday and climb up to its 1.165 resistance especially with other EUR pairs either reversing up or continuing to gain bullish traction.

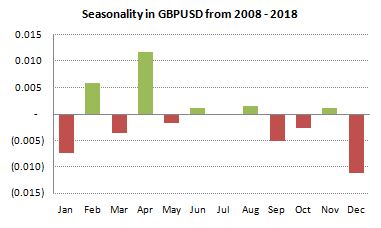

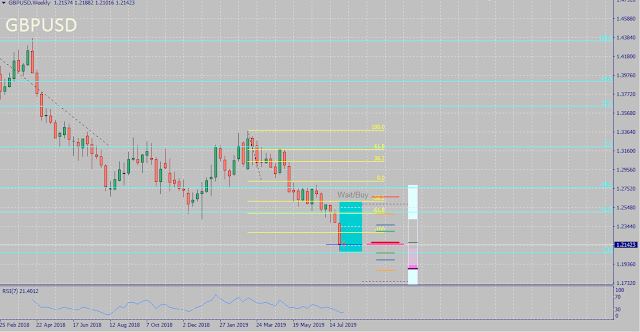

GBPUSD

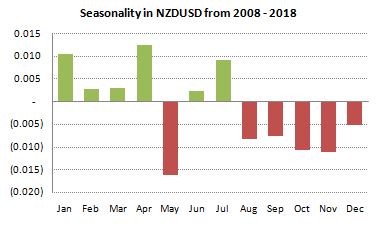

Early this month, we might see a short-term recovery on the pound, but seeing its seasonality in the succeeding months plus a hardcore Brexiter as UK's new PM, it's safer to just wait for a better entry on the upside instead of risk getting whipsawed, and simply continue shorting GBP pairs.NZDUSD

Like AUD, the recovery I was expecting for NZD never happened last month. We'll see if it does this early this month, or simply wait for a better entry to go short in the long-run or at least until NZDUSD reaches 0.62.USDCAD

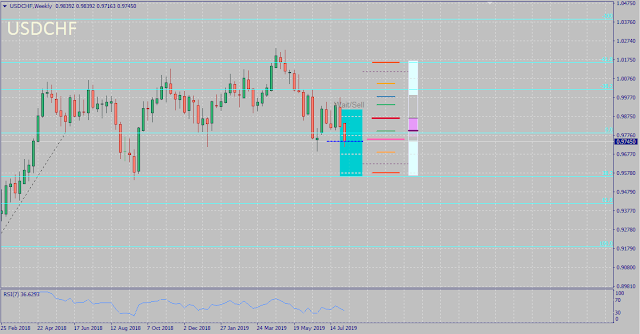

As mentioned earlier, the bullish momentum on oil from agreed production cut won't be that obvious until probably the -ber months start by next month. Expecting this to go either range-bound or simply ride DXY's movement.USDCHF

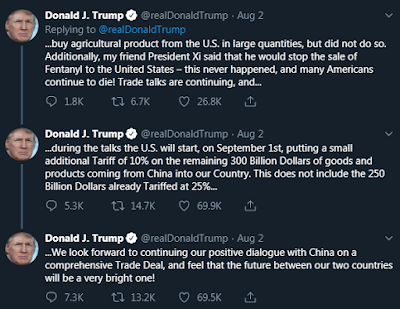

Expecting this pair to continue going bearish not only based on its August seasonality but also with recent bearish dollar, EUR recovery, and increased appeal of safe haven assets (CHF being one of them) while trade "talks" are getting nowhere.USDJPY

Unlike USDCHF above, expecting USDJPY to actually recover at least in the short-run this month, because the BOJ will most likely intervene again and add more easing soon, as they won't let their already pricey exports to be less competitive.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for August 2019

S&P 500*

Whether it will recover again soon or plunge down to hell depends on general market sentiment and opinion whether a recession indeed forthcoming or just nonsense paranoia. My take on equities is still the same as last month: wait for it to drop to 2500 before buying stocks again (unless you can cherry-pick stocks that are already at a bargain now and plan to sell them immediately as soon as they rise within the week or month-- then by all means, buy them).

Gold*

I admit this metal is starting to look overbought now, so its advisable to buy again after it bounces from 1500 (or lower maybe) to near 1400 new support, or better yet, right after confirmed reversal on DXY @100 later this year, unless you're good in day trading and can move in and out quickly.

Silver*

Similar logic as gold above, wait for better entry near 15.5 - 16 before buying up to 17, or wait and ride the reversal on the latter instead since this metal is also already overbought and may serve as hedge on any bearish USD positions like being long in gold.Oil*

Oil's seasonality for this month continues to be directionless and will start going bullish by September. Based on price action, it seems like it's actually good opportunity to start buying oil now. But to be safe especially with trade "talks" affecting it, it's best to wait for cold -ber months before going long again here.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

Feature image by Michael S. of Pexels

0 comments:

Post a Comment