FX Seasonality Forecast for May 2019 and FX Trading Ideas for the Week | Apr 29 - May 3, 2019

Finally! 😄

More time for me in transforming some of my hobbies into a proper business now to ensure growth, and also about to start 2 side projects by summer-- one of them I'm very excited about because it's gonna be a revamped collab with my S.O.!

But since I have a weird obsession with trading and a recovering workaholic, let's get this monthly seasonality forecast out of the way even before May.

I. Outcome of FX Seasonality-Based Prediction for April 2019

Unlike last March, the forecast for April didn't play out as much as I expected mainly because of US Dollar Index climbing up further to reach the 100 fib line instead of bouncing down again from its current resistance level @97.At least most of them still fell within my forecasted range except for 2: NZDUSD and USDCHF. They were totally off, the former because of the sudden dovish tone from RBNZ, and the latter because of the recent push and cautious optimism in the S&P 500.

Let's see if DXY further climbs to touch 100 at least between now and mid this year before finally correcting.

II. Forecast for May 2019 Based on Recent 10-Year FX Seasonality

Keeping an eye closely on USD Index and S&P 500. Ceteris paribus, if nothing much will change with current momentum, then the seasonality forecast below will hold true. But if it turned out that the markets actually went ahead last month with May's seasonality, then the opposite will happen instead. For best results, I'll remain more cautious between now and August, or until I finally see DXY and S&P 500 dropping (and who knows, maybe cryptos finally rising again *shrugs*), because those things are more aligned in all 3 things: price action, macroeconomic fundamentals, and technicals.AUDUSD

In line with it's May seasonality, expecting the Aussie to continue dropping further at least at 0.68, if not somewhere nearer its weekly 61.8 fibonacci level especially after a weaker than expected recent Chinese PMI.But need to be extra careful because in the bigger picture, I'm now bullish both in AUD and China, not only because of its Belt and Road initiative and asteroid mining goals, but also with this Digital Silk Road plans-- and they have huge advantage already for having the majority of supplies needed for tech parts.

Add their very sneaky hacking teams and also huge funds, and nothing can stop China, I'm actually considering studying Mandarin again lol (my dad annoyingly stopped me from continuing it. He said I should study French instead of "nonsense" Chinese and kept laughing at me.

He was wrong. I'm right. I wish I was more assertive when I was younger, but moving on...).

EURUSD

Although EURUSD's seasonality forecast for May indicates more room on the downside, since it now touched the critical weekly 61.8 fibonacci level, it's more likely to remain sticky and ranging in that zone instead of dropping all the way to 1.04 (100 fib level) especially the markets will definitely wait on the next ECB meeting this June before committing to a certain position.Despite recent dovish tone by the ECB, I think EUR will bounce up soon with Draghi being reluctant to let go of its easing and even planning to introduce the TLTRO (Targeted Long-Term Refinancing Operation) by fall. The EU will do anything to counter any Chinese influence especially its Belt and Road initiative.

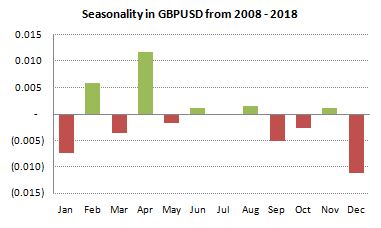

GBPUSD

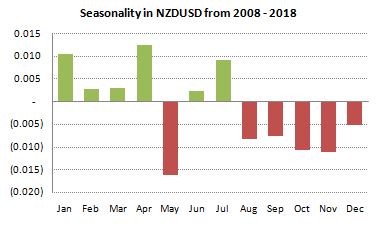

The pound didn't rise up that much in April as forecasted by its 10-year history below, but if USD index goes in a correction now, then expect GBPUSD to have a delayed reaction and rise on May instead. Overall, its best to wait or just scalp this pair to get in and out as quickly as possible and not get burned by either Theresa May and Trump.NZDUSD

Almost same thing with GBPUSD, instead of going up in April, it went down even past 0.67 thanks to sudden dovish tone by RBNZ. Now that it's priced in, expecting the Kiwi to recover slightly this month or slide near the sticky weekly 0 fib level, depending on how US dollar plays out. Overall I'm still bullish on Kiwi, it's highly underrated. But will wait on further confirmation especially on price action before going long.USDCAD

Based on this pair's May seasonality and on-going hype on US Dollar index, and current consolidation in oil now, highly likely for this pair to try climbing near 1.40. Either scalp that, or better just stay out, keep alerts on, and ride the possible sudden correction after it reaches the top instead.USDCHF

Almost same logic as USDCAD above but has a more defined resistance level at 1.03 (0 fib level) to keep watch on. But need to be more extra cautious here because unlike with USDCAD and a generally bullish outlook on oil overall, S&P 500 is more likely to cause some whipsaws not only in USD pairs but most especially on CHF and JPY pairs.USDJPY

Still expecting this pair to continue going range-bound at least until June.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for May 2019

S&P 500*

I'm kinda new in learning and using Elliot Wave so I don't know yet if I've plotted it correctly below --only time and more experience will tell. Anyway, with its May positive seasonality and knowing the Fed, expecting the S&P 500 to actually continue climbing up past 3,000 (but won't reach 3,500 yet), and once they think they've "fooled" the masses into going risk-on, that's when the "c" correction wave will occur.

Also classic text-book pump-and-dump.

Edit: This dude put the charts into words perfectly.

Also classic text-book pump-and-dump.

Edit: This dude put the charts into words perfectly.

Gold*

Expecting this metal to go ranging in the weekly 0 fib level this month, and probably form a bowl once USD index starts correcting (but S&P 500 will most likely keep on rising to create its pump-and-dump scenario mentioned above).

Silver*

Unlike gold, silver is more likely to continue going down near 14 because of the sticky weekly 61.8 fib level and also as a reaction to continued rise in USD index.Oil*

Now that oil reached 64 as predicted in last month's seasonality forecast, I have no opinion at the moment aside from just wait for some correction, possible down to 60, before going bullish again.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

IV. FX Trading Ideas for the Week

AUD - Sell (short-term)

Continue selling (at least in the short-run) especially after the slightly disappointing Chinese PMI earlier.AUDCAD - Sell with TP near 0.94 - 0.943

AUDCHF - Wait for bearish confirmation past 0.716 then sell with TP near 0.708

AUDJPY - Wait for better entry to sell, ideally near 79

AUDNZD - Scalp up past 1.05825 with TP near 1.06 - 1.06225, else avoid trading this for now

AUDUSD - Wait for better entry to sell, ideally near 0.71

EURAUD - Wait near 1.59

GBPAUD - Wait for better entry to buy, ideally near 1.83 or lower

CAD - Wait

With the wait-and-see mode in oil and recent dovishness by BoC, CAD pairs are currently more driven by other currencies. Best to wait for better entry levels or ride any good scalping opportunities as long as the risk-reward ratio shows that it's worth it doing so.CADCHF - Wait for bounce from 0.76 or bearish confirmation past 0.755 before selling with TP near 0.75

CADJPY - Wait for better entry to buy, ideally near 82.5

EURCAD - Wait for better entry to sell, ideally near 1.508 - 1.51, with initial TP near 1.499 - 1.50

GBPCAD - Wait for better entry to buy, ideally near 1.733 with initial TP @1.75

NZDCAD - Wait for better entry to sell, ideally near 0.90 - 0.905, then sell with initial TP @ 1.886

USDCAD - Wait for better entry to buy, ideally near 1.34, with initial TP near 1.35342

AUDCAD - Sell with TP near 0.94 - 0.943

CHF - Wait

Best to wait for confirmation especially on how S&P 500 will play out soon and see if the market is going "fake" risk-on or genuine risk-on before getting in any CHF position (unless for short-term trading opportunities).CHFJPY - Wait for confirmed bounce from 109.15 then buy with initial TP near 111

EURCHF - Wait near 1.14

GBPCHF - Wait near 1.32

NZDCHF - Wait for bearish confirmation past 0.6785 then sell with TP near 0.672

USDCHF - Wait near 1.018

AUDCHF - Wait for bearish confirmation past 0.716 then sell with TP near 0.708

CADCHF - Wait for bounce from 0.76 or bearish confirmation past 0.755 before selling with TP near 0.75

EUR - Wait

Possibly continue selling in the short-term as reflected by its May seasonality, but need to be careful because aside from possibly being oversold already, Draghi and his folks are still reluctant to let go of easing especially after Italy welcomed China's help.EURGBP - Wait for bearish confirmation past 0.86 then sell with TP near 0.85

EURJPY - Wait for better entry to buy, ideally near 124, with TP @126

EURNZD - Wait near 1.685

EURUSD - Wait near 1.12

EURAUD - Wait near 1.59

EURCAD - Wait for better entry to sell, ideally near 1.508 - 1.51, with initial TP near 1.499 - 1.50

EURCHF - Wait near 1.14

GBP - Buy (short-term)

Continue buying the pound at least in the short-run especially with this newfound optimism regarding Brexit.GBPNZD - Wait near 1.935

GBPUSD - Wait near 1.295

EURGBP - Wait for bearish confirmation past 0.86 then sell with TP near 0.85

GBPAUD - Wait for better entry to buy, ideally near 1.83 or lower

GBPCAD - Wait for better entry to buy, ideally near 1.733 with initial TP @1.75

GBPCHF - Wait near 1.32

NZD - Sell (short-term)

Just riding the remaining bearish momentum until it finally settles down. Or wait in the sidelines until it's best to go long again especially being bullish is more aligned with macroeconomic fundamentals for NZ and also NZD is getting oversold.NZDJPY - Wait for better entry to sell, ideally near 75, then sell with initial TP near 73.45

NZDUSD - Wait for better entry to sell, ideally near 0.67, then sell with TP near 0.66

AUDNZD - Scalp up past 1.05825 with TP near 1.06 - 1.06225, else avoid trading this for now

EURNZD - Wait near 1.685

GBPNZD - Wait near 1.935

NZDCAD - Wait for better entry to sell, ideally near 0.90 - 0.905, then sell with initial TP @ 1.886

NZDCHF - Wait for bearish confirmation past 0.6785 then sell with TP near 0.672

JPY - Wait

With Golden Week coming soon (no latest Jojo episode :( ) best to avoid or liquidate any JPY positions now and trade again next week.USDJPY - Wait near 112

AUDJPY - Wait for better entry to sell, ideally near 79

CADJPY - Wait for better entry to buy, ideally near 82.5

CHFJPY - Wait for confirmed bounce from 109.15 then buy with initial TP near 111

EURJPY - Wait for better entry to buy, ideally near 124, with TP @126

GBPJPY - Buy with TP near 145.55

NZDJPY - Wait for better entry to sell, ideally near 75, then sell with initial TP near 73.45

USD - Wait

Because of 100-fib level still above its current resistance (aside from the USD fanboys in the forums), I'm not surprised USD hasn't lost its steam yet despite a bearish outlook for its April seasonality. With more expectation that USD index will reverse soon, unless I see a shooting star and a bearish engulfing candle afterwards, USD still has room to go up and even touch 100 before reversing.AUDUSD - Wait for better entry to sell, ideally near 0.71

EURUSD - Wait near 1.12

GBPUSD - Wait near 1.295

NZDUSD - Wait for better entry to sell, ideally near 0.67, then sell with TP near 0.66

USDCAD - Wait for better entry to buy, ideally near 1.34, with initial TP near 1.35342

USDCHF - Wait near 1.018

USDJPY - Wait near 112

XAUUSD - Wait near 1282.5

XAGUSD - Wait near 15

XTIUSD - Wait near 63

USDZAR - Wait for better entry to buy, ideally near 14.105 then buy with TP near 14.7

USDMXN - Wait near 19.05

0 comments:

Post a Comment