FX Seasonality Forecast for March 2019 and FX Trading Ideas for the Week | Mar 4 - 8, 2019

I. Outcome of FX Seasonality-Based Prediction for February 2019

Overall the pairs moved within the predicted range (blue box), EURUSD was a bit bearish than I expected because the current expectation now regarding lesser risk of having a no-deal Brexit was bullish on GBP and slightly bearish on EUR (although imho, in the bigger picture that's more bullish on EUR because no Brexit means Bremain lol). But aside from that, there are also some other political and economic risks in the Euro zone that I forgot to consider last month such as the debt issue with Italy, an upcoming snap election in Spain on April, and the yellow vest activists in France-- wow, ok that's a lot.USDJPY on the other hand, though still within my forecasted range, went more bullish than I expected--most likely because of that news regarding fake economic data from Japan as I've mentioned during the 2nd week of Feb, and continued general dovishness of the BOJ as well.

Back to Top

II. Forecast for March 2019 Based on Recent 10-Year FX Seasonality

AUDUSD

Expecting AUDUSD to go in a much tighter range this month-- between 0.70 to o.72, and won't start recovering or rallying yet, at least until there's a confirmed reversal already in the USD Index (DXY).EURUSD

Either EURUSD will continue ranging this month, or might drop early to 1.10, way past my forecast range depending on how the political and economic risks in the Euro zone (mentioned above) will pan out.

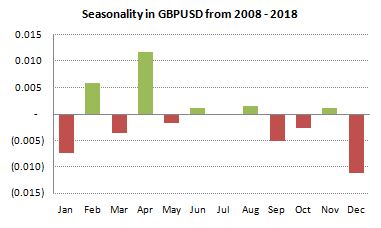

GBPUSD

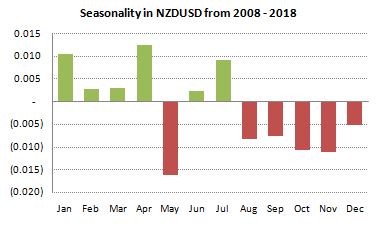

Expecting a consolidation for GBPUSD back to 1.30 this month, with possibility of a sudden breakout past 1.34 near Brexit deadline if it's confirmed that such will actually be delayed and also if a 2nd referendum will occur.NZDUSD

Expecting NZDUSD to go in a narrower range this month, with possibility of suddenly rising to 0.70 or even breaking past that level, depending on how DXY goes.USDCAD

Expecting this pair to probably rise a bit but only up to 1.34 before bouncing down to 1.31, especially I have a bullish bias on oil despite Trump making a lot of noise against it previously-- even more so if S&P 500 suddenly drops instead of breaking out and signaling the end of the dip, and making the market even more risk-off and reduced investments in US shale oil drillings.USDCHF

USDCHF is more likely to bounce from its current resistance level at 1.01207 (2018 high) down to 0.98, or continue moving on a narrower range instead of breaking out-- but we'll see.USDJPY

Unlike USDCHF, considering its March seasonality also below, its more likely that USDJPY will continue rising up to 114 at least before bouncing back again to 110.Back to Top

III. Forecast Attempt in S&P500, Oil and Metals for March 2019

S&P 500*

Unlike the previous 2 months, I have no opinion now regarding S&P 500. With its March seasonality as well as the fact that the Fed can easily buy more stocks, it's tempting to say that the dip might be over and S&P 500 is now bound to rise even past 3000. But looking at its price action on both weekly and daily charts, and macroeconomic fundamentals (and even political risks), I'm *not-so-secretly* biased on it going bearish-- being the worse just yet to come.

Gold*

If my bearish bias on S&P 500 above turn out wrong, USD Index will definitely continue rising along with equities, and gold may drop to 1240. Else, it's more likely that gold will recover soon and climb back to 1320 or more.

Silver*

More likely for silver to go ranging below 15.50 this month instead of breaking out, with the possibility of dropping to 14.50 if S&P 500 and USD Index suddenly breaks out on the up side.Oil*

Most likely for oil to climb up again up to 60 especially with more limited supplies agreed upon last December by OPEC with Russia. Also rumored reduced investment on US shale oil can also affect the supply, as well as Trump's sanctions on Iran.*Note: Unlike FX pairs, S&P500, Oil and Metals don't really "follow" their monthly seasonality that's why I didn't include their seasonality charts anymore to avoid confusion. I don't see any consistency on them by simply eyeballing the charts.

Back to Top

IV. FX Trading Ideas for the Week

AUD - Wait

Still cautious on AUD especially with its struggling housing market and slightly dovish tone of RBA despite keeping the rates unchanged. But in the short-term, might ride any possible rally after its drop along with gold.AUDCAD - Wait for bullish continuation past 0.9446 then buy with target profit near 0.95

AUDCHF - Wait near 0.708

AUDJPY - Wait for possible bounce from 79 then buy with target profit @80

AUDNZD - Wait near 1.038

AUDUSD - Wait for bullish confirmation past 0.71 then buy with target profit near 0.72

EURAUD - Wait for bearish continuation past 1.60 and sell with target profit near 1.57

GBPAUD - Wait for bounce near 1.795 then sell with target profit @1.755 -1.765

CAD - Wait

Same as last week-- still in waiting mode until I get bullish confirmation from oil, plus the BOC rate statement on Wednesday.CADCHF - Wait for bearish confirmation past 0.747 then sell with target profit @0.74

CADJPY - Wait near 84

EURCAD - Wait for bullish continuation past 1.51250 then buy with target profit near 1.525

GBPCAD - Wait for bearish confirmation past 1.75 then sell with target profit @1.73

NZDCAD - Wait near 0.91

USDCAD - Wait near 1.335

AUDCAD - Wait for bullish continuation past 0.9446 then buy with target profit near 0.95

CHF - Wait

Similar to last week as well but a little more cautious, so it's best to wait until I get enough confirmation of from S&P500 of a bullish breakout and end of dip (currently it's still in the 2800 fence like Humpty Dumpty).CHFJPY - Wait for bullish continuation past 112.281 then buy with target profit near 113.5

EURCHF - Wait near 1.132

GBPCHF - Wait for bearish confirmation past 1.31385 then sell with target profit near 1.305

NZDCHF - Wait for bullish confirmation past 0.68317 then buy with target profit near 0.69

USDCHF - Wait near 1.00

AUDCHF - Wait near 0.708

CADCHF - Wait for bearish confirmation past 0.747 then sell with target profit @0.74

EUR - Wait

With upcoming refinancing and ECB meeting during the middle of the week, it's best to wait for now.EURGBP - Wait for bullish confirmation near 0.865 then buy with target profit at 0.88

EURJPY - Wait near 126.5

EURNZD - Wait for bearish confirmation near 1.66 then sell with target profit near 1.65

EURUSD - Wait near 1.134

EURAUD - Wait for bearish continuation past 1.60 and sell with target profit near 1.57

EURCAD - Wait for bullish continuation past 1.51250 then buy with target profit near 1.525

EURCHF - Wait near 1.132

GBP - Sell

Though there are still remaining bullish sentiment in the market related to the 2nd referendum and no more no-deal Brexit, aside from its slightly bearish March seasonality bias, technically GBP pairs are now overbought and might be bound for some correction at least. I have a feeling that GBP will suddenly sell-off either after March 12 or later part of March, once the Brexit initial deadline concludes, but we'll see. |

| Chart from Bloomberg |

GBPNZD - Wait for bearish confirmation at 1.92655 then sell with target profit near 1.905

GBPUSD - Wait near 1.317

EURGBP - Wait for bullish confirmation near 0.865 then buy with target profit at 0.88

GBPAUD - Wait for bounce near 1.795 then sell with target profit @1.755 -1.765

GBPCAD - Wait for bearish confirmation past 1.75 then sell with target profit @1.73

GBPCHF - Wait for bearish confirmation past 1.31385 then sell with target profit near 1.305

NZD - Buy

Current bias hasn't changed as last week's: continue to be strongly bullish but remain cautious regarding AUD's movement.NZDJPY - Wait for bullish confirmation past 76.556 then buy with target profit near 77.5

NZDUSD - Wait near 0.68

AUDNZD - Wait near 1.038

EURNZD - Wait for bearish confirmation near 1.66 then sell with target profit near 1.65

GBPNZD - Wait for bearish confirmation at 1.92655 then sell with target profit near 1.905

NZDCAD - Wait near 0.91

NZDCHF - Wait for bullish confirmation past 0.68317 then buy with target profit near 0.69

JPY - Wait

Best to wait like CHF above until I get further confirmation if the market will remain risk-off, or if S&P500 will jump higher and market becomer risk-on.USDJPY - Wait near 111.75

AUDJPY - Wait for possible bounce from 79 then buy with target profit @80

CADJPY - Wait near 84

CHFJPY - Wait for bullish continuation past 112.281 then buy with target profit near 113.5

EURJPY - Wait near 126.5

GBPJPY - Wait for bearish confirmation past 146.9 then sell with target profit near 145.5

NZDJPY - Wait for bullish confirmation past 76.556 then buy with target profit near 77.5

USD - Wait

Based on its seasonality bias this month, recent mixed/uncertain movements in US treasury yields, and also getting burned last week lol, it's best to wait in the sideline for now until I get enough confirmation (most likely the sign will start on S&P 500).AUDUSD - Wait for bullish confirmation past 0.71 then buy with target profit near 0.72

EURUSD - Wait near 1.134

GBPUSD - Wait near 1.317

NZDUSD - Wait near 0.68

USDCAD - Wait near 1.335

USDCHF - Wait near 1.00

USDJPY - Wait near 111.75

XAUUSD - Wait for bounce near 1275 then buy with target profit near 1320

XAGUSD - Wait near 15

XTIUSD - Wait for bullish confirmation near 57, then buy with target profit @60

USDZAR - Wait for bearish confirmation near 14.14 then sell with target profit near 13.9

USDMXN - Wait near 19.25

0 comments:

Post a Comment